CONSTRUCTION

Your blueprint for growing profits

Construction is a high-risk, high-reward business where financial mistakes can sink a project. Arvo manages the financial backend with the precision you bring to the field, providing the control and clarity you need to protect your margins and build a stronger business.

Master job costing to ensure every project is profitable

Improve cash flow with expert management of progress billings and retainage

Simplify subcontractor payments and compliance tracking

Win more profitable bids with precise, data-driven estimates

Free up your team to focus on the job site, not the paperwork

R&D

The government wants to pay you for spending on research and development. Let them.

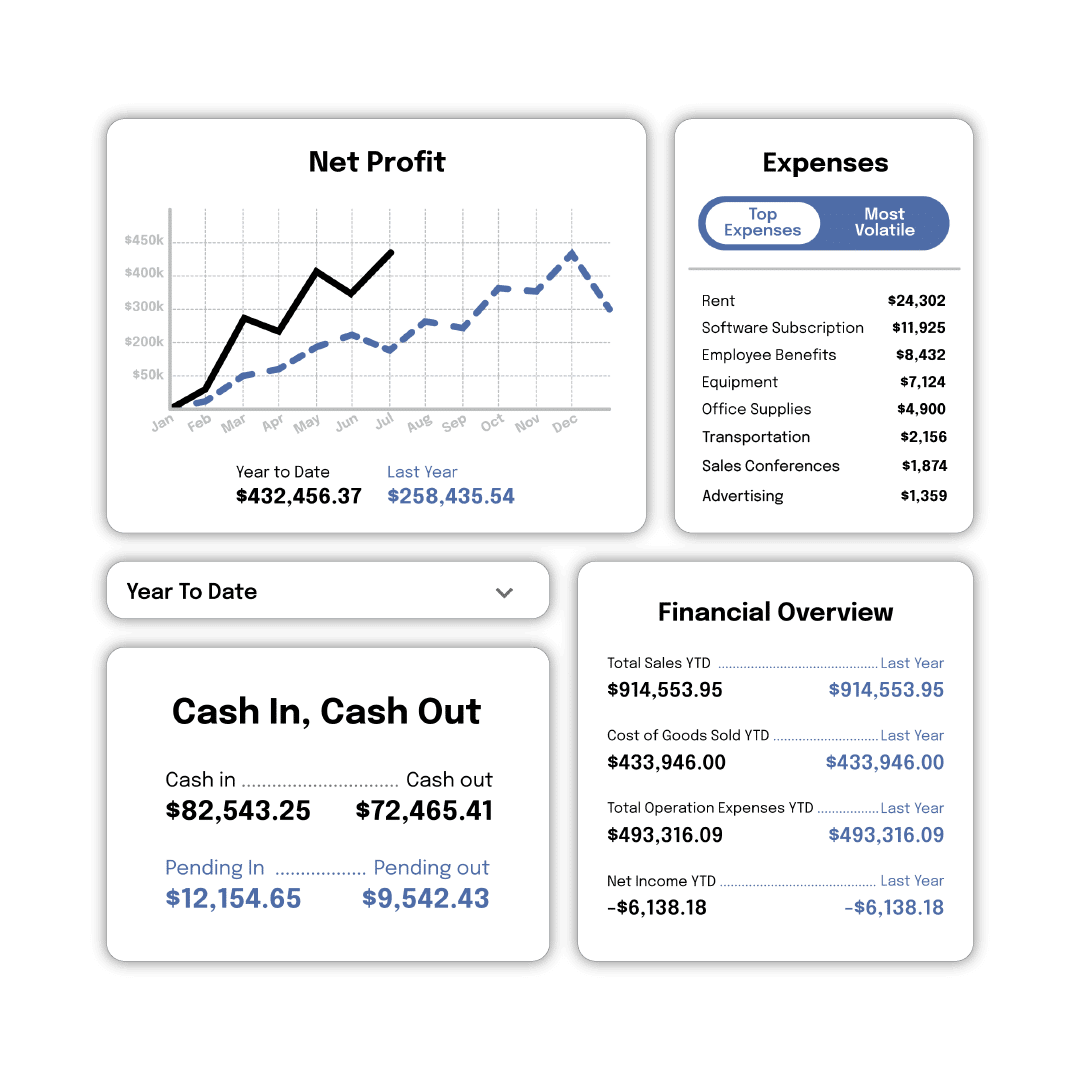

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax

Don’t just file. Know you’re capitalizing on every available opportunity.

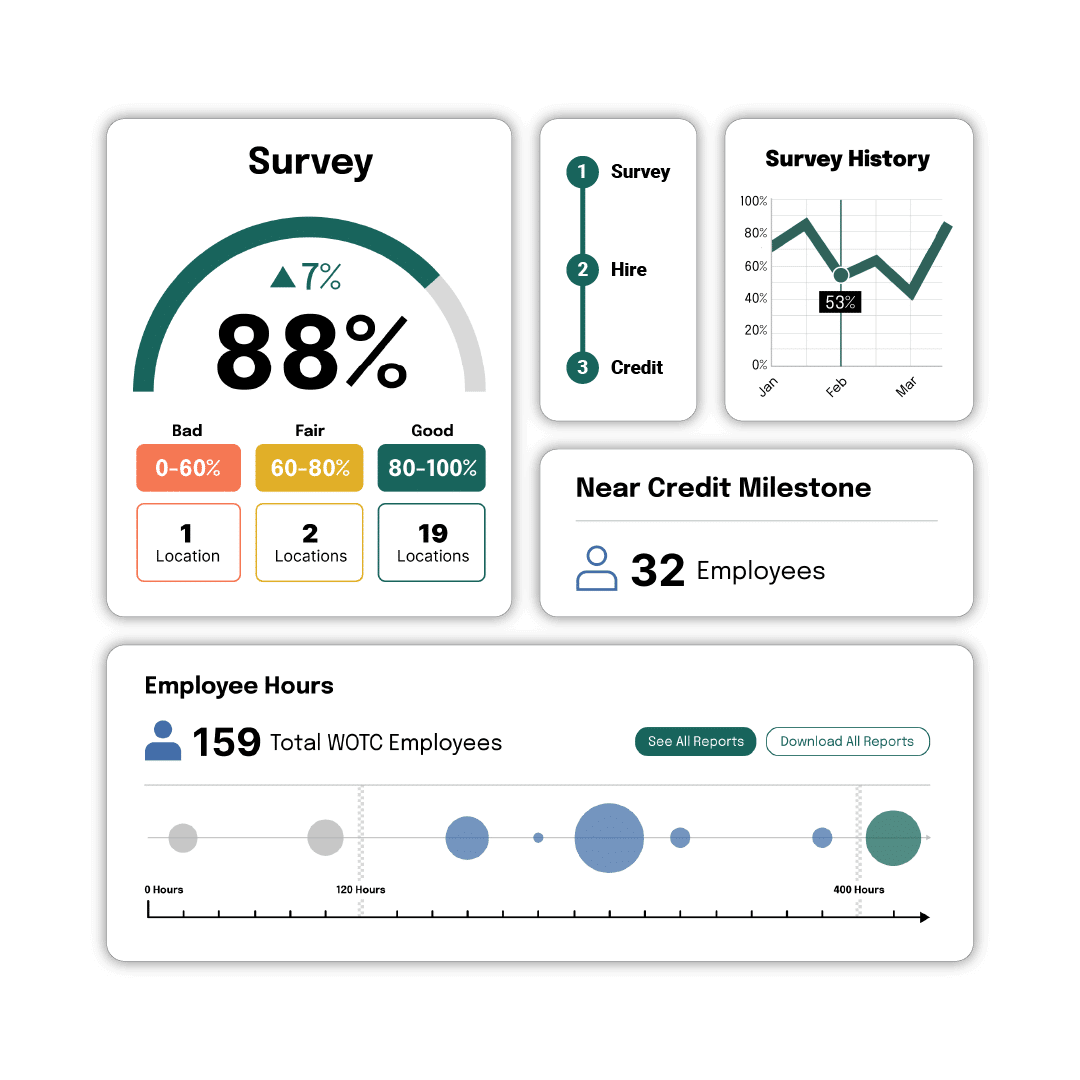

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

Groundwork for growth

We lay the financial groundwork that allows construction firms to scale confidently, from local subs to regional GCs. The results are concrete.

$236,006

Average R&D tax credit claim for medical companies

20%

Average percentage of construction teams who qualify for WOTC

$9,600

Maximum potential WOTC value per eligible employee

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questiosn. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

Bookkeeping for job cost control

Running blind on job costs is a direct path to lost profits and project delays. Arvo delivers reliable, accurate financials purpose-built for construction. Gain immediate insight into labor, materials, equipment, and subcontractor costs, empowering you to make smarter decisions in the field and ensure every project builds your bottom line.

Tax opportunities for innovative builders

Construction finance experts

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on your federal taxes for hiring new employees from diverse backgrounds. The process is simple and rewarding.

Aunt Flo saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

How Architecture & Engineering Firms Can Capitalize on New R&D Tax Laws

Join our tax experts on October 28, 2025 at 3:00 PM EST to beat the R&D rush.

What’s your growth strategy?

Join over 5,000 businesses that have trusted their tax and accounting with Arvo.

How do you handle construction-specific job costing and WIP reporting?

Understanding project profitability is central to our service for construction firms. Our approach is designed to help you track key project-related costs and revenue. We provide clear financial reporting that gives you greater visibility into how your projects are performing, which is essential for managing your business effectively.

We use specific construction management software. Can you integrate with it?

We understand that construction firms rely on a variety of specialized software. Our team is experienced in working with data from different systems to ensure your financial picture is complete and accurate. Our goal is to create an efficient process that reduces administrative burden and provides you with reliable financial data.

Our cash flow is always tight because of retainage. How can you help?

Managing cash flow is a critical challenge in construction. We help by providing clear and timely financial reporting that gives you greater visibility into your cash position. This clarity allows you to better forecast your financial needs and make more informed strategic decisions to improve the overall financial health of your business.

How do you manage payments and compliance for our subcontractors?

We can help support the administrative side of managing subcontractors. Our services are designed to bring clarity and organization to your accounts payable and compliance processes. By helping you stay organized, we can reduce your administrative workload and help mitigate the financial risks associated with subcontractor management.