ENGINEERING

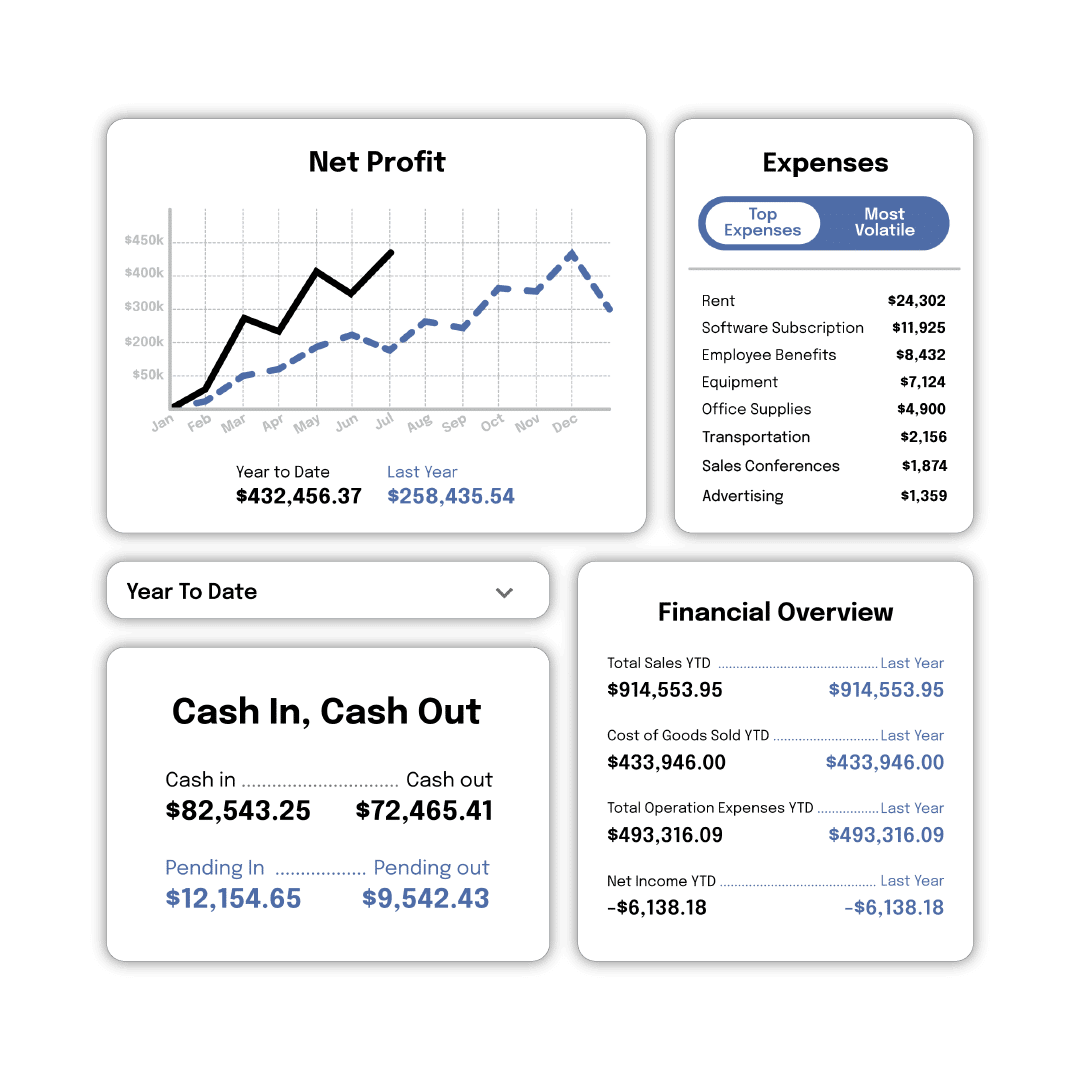

Accurate financials, down to the decimal

Engineering firms run on precision, but inaccurate financials can derail the most brilliant projects. Arvo manages your financial operations with the same rigor you apply to your work, providing the structural integrity your firm needs to be more profitable.

Master project profitability with precise job costing and analysis

Improve cash flow with optimized billing and expense tracking

Secure R&D tax credits for your problem-solving

Make confident bids based on accurate historical data

Free team members to focus on billable work and clients

R&D

The government wants to pay you for spending on research and development. Let them.

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax

Don’t just file. Know you’re capitalizing on every available opportunity.

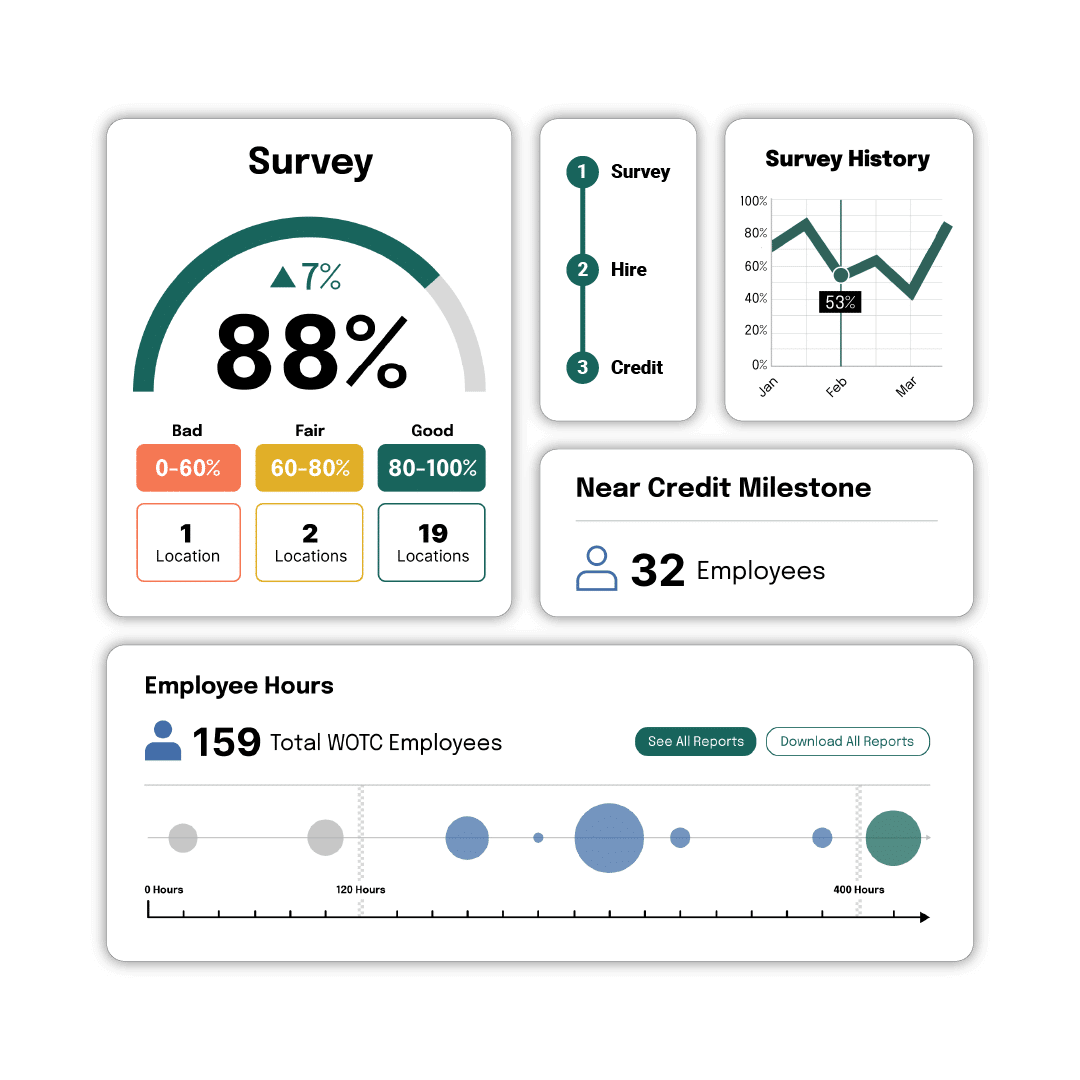

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

A framework for growth

25

Engineering activities deemed “routine” that may qualify for tax incentives

R&D

Most overlooked tax credit for engineering clients

$203,750

Average R&D tax credit claim for engineering firms

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questiosn. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

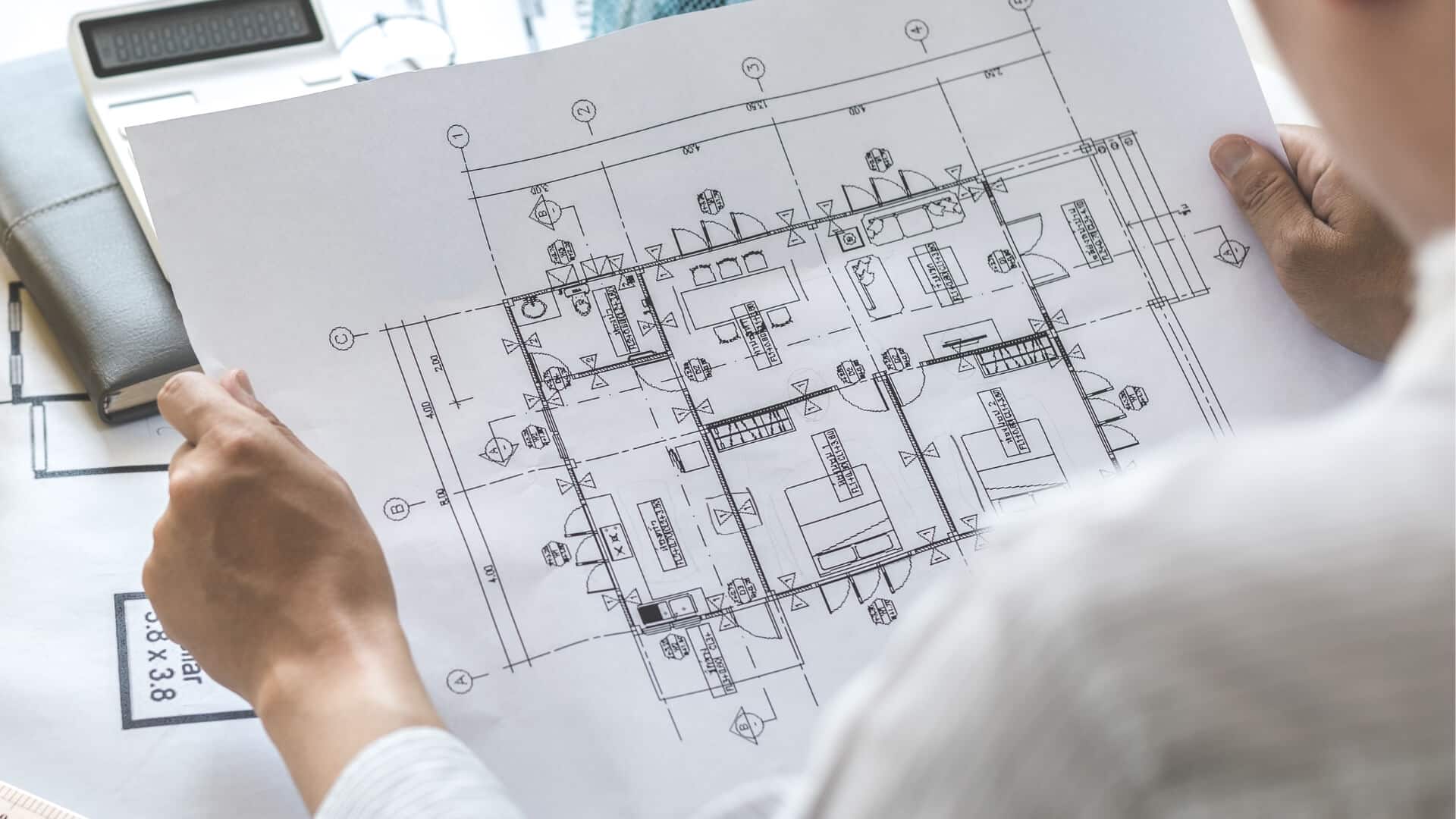

Bookkeeping for project profitability

Inaccurate job costing or budget overruns can quickly erode engineering project profitability. Arvo delivers the precise, on-time financial data you need to manage complex projects with confidence. Gain immediate clarity on labor hours, material costs, and subcontractor expenses, ensuring every technical challenge contributes positively to your firm’s bottom line.

Tax credits for technical innovation

Your firm’s problem-solving and design process—from initial concept and CAD to modeling, testing, and validation—is rich with R&D. Arvo are experts at identifying these qualifying activities within the engineering lifecycle. We handle the complex documentation, transforming your technical challenges into substantial R&D tax credit returns.

Engineering finance experts

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on your federal taxes for hiring new employees from diverse backgrounds. The process is simple and rewarding.

Aunt Flo saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

How Architecture & Engineering Firms Can Capitalize on New R&D Tax Laws

Join our tax experts on October 28, 2025 at 3:00 PM EST to beat the R&D rush.

What’s your growth strategy?

Join over 5,000 businesses that have trusted their tax and accounting with Arvo.

How do you handle job costing for multi-phase, long-term projects?

Handling complex projects is a core part of our service. Our process is designed to track key project financials, like expenses and labor, across multiple phases. We provide clear and timely reports that give you insights into project performance, so you can effectively manage budgets and identify potential issues before they impact your bottom line.

What specific engineering activities qualify for R&D tax credits?

A significant portion of your firm’s work likely qualifies. This includes activities like developing new or improved designs, creating and testing prototypes, using advanced modeling or simulation software to evaluate alternatives, and developing more efficient processes. Our specialists conduct a thorough study to identify every qualifying activity and maximize your credit.

Our firm works on government contracts. Can you handle the specific compliance?

Yes. We have extensive experience with the stringent accounting and compliance requirements associated with government contracts, including FAR (Federal Acquisition Regulation) and DCAA (Defense Contract Audit Agency) standards. We ensure your books are always compliant and audit-ready, protecting your firm and your contracts.

How do you help us improve our bidding and proposal process?

By providing clean, accurate historical data. Our detailed job costing reports show you exactly how profitable past projects were, allowing you to identify trends and create more accurate, competitive bids for future work. When you know your true costs with certainty, you can bid to win without sacrificing your margins.