MANUFACTURING

Financials as efficient as your production line

Manufacturers face unique financial hurdles that can erode margins and obscure profitability. Arvo manages this complexity with precision, providing the financial controls and strategic insight you need to build a more profitable operation.

Gain control over inventory costing and COGS

Improve cash flow with streamlined supply chain expense management

Claim R&D tax credits for your process improvements

Make informed decisions with clear profitability analysis by product line

Reclaim leadership time to focus on production and quality control

R&D

The government wants to pay you for spending on research and development. Let them.

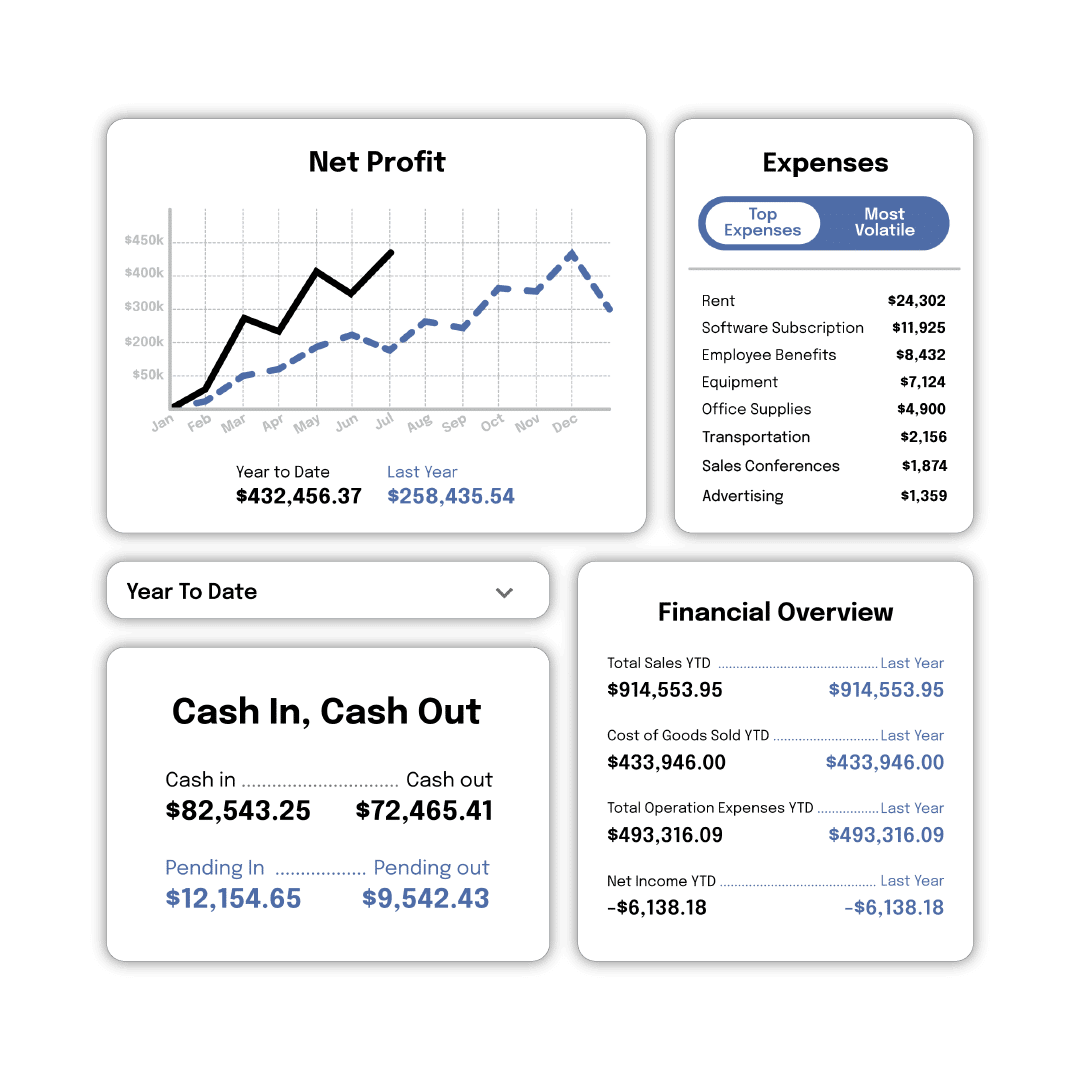

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax

Don’t just file. Know you’re capitalizing on every available opportunity.

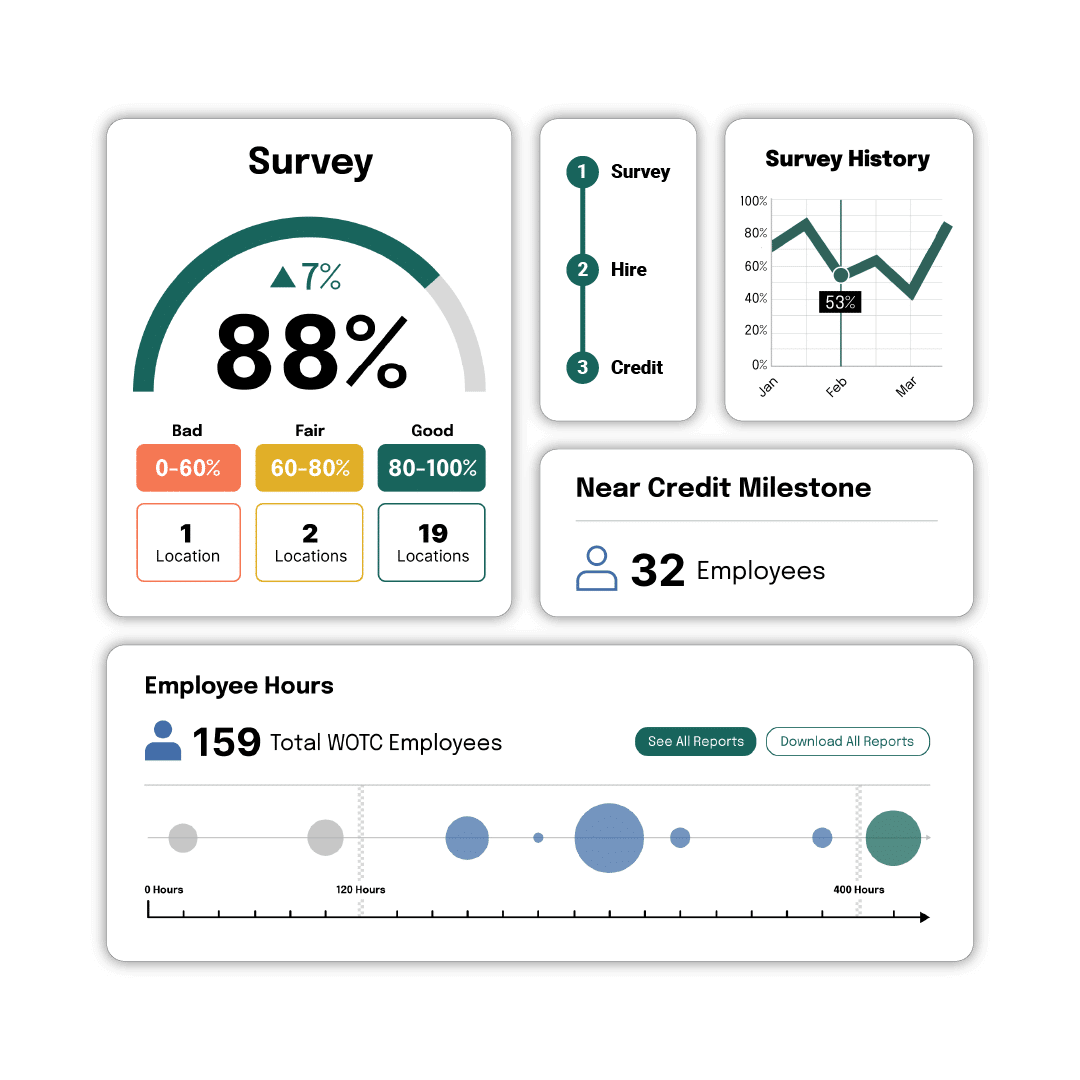

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

Build a stronger bottom line

We build long-term partnerships with manufacturers, providing the financial controls they need to manage costs, improve margins, and grow their operations. The numbers speak for themselves.

1

Manufacturing rank in list of industries qualifying for R&D tax incentives

$203,950

Average R&D tax credit claim for manufacturers

20%

Average percentage of manufacturing employees who qualify for WOTC

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questiosn. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

Bookkeeping for operational clarity

Making production decisions with outdated financials costs you time and money. Arvo delivers accurate, on-time financial data for manufacturers. Gain instant clarity on material costs, labor efficiency, inventory turnover, and overhead, empowering you to optimize operations, manage supply chains, and drive profitable production.

Tax credits for innovative teams

Manufacturing finance experts

Meet the team dedicated to your company’s financial health. Our experts understand the nuances of the manufacturing industry, from inventory costing to capital expenditures, providing the clarity you need to scale.

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on your federal taxes for hiring new employees from diverse backgrounds. The process is simple and rewarding.

Aunt Flo saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

How Architecture & Engineering Firms Can Capitalize on New R&D Tax Laws

Join our tax experts on October 28, 2025 at 3:00 PM EST to beat the R&D rush.

What’s your growth strategy?

Join over 5,000 businesses that have trusted their tax and accounting with Arvo.

How do you handle complex inventory accounting and COGS?

This is a core part of our service for manufacturers. We implement robust systems to accurately track inventory from raw materials to finished goods, using the costing method (e.g., FIFO, LIFO) that best suits your business. This provides a precise Cost of Goods Sold (COGS), which is critical for accurate profitability analysis and inventory management.

What kind of manufacturing work qualifies for the R&D tax credit?

A wide range of activities on your factory floor can qualify. This includes developing new or improved manufacturing processes, designing and building custom tooling and equipment, automating production tasks, testing new material compositions, and developing prototypes. Our specialists will analyze your operations to identify and document all qualifying activities to maximize your claim.

We have large capital expenditures. Can you help manage depreciation?

Yes. We have deep expertise in managing fixed assets and capital expenditures. We will set up and maintain detailed depreciation schedules for your machinery and equipment, ensuring you take full advantage of tax benefits like bonus depreciation and Section 179 deductions. This helps to minimize your tax liability and improve your cash flow.

Our raw material costs fluctuate. How do you help us manage that?

We provide you with timely and accurate financial reports that give you a clear view of how material cost fluctuations are impacting your COGS and gross margins. This allows you to make proactive decisions about pricing, supplier negotiations, and inventory levels. With our data, you can better anticipate and respond to supply chain volatility.