WOTC grows margins

By capturing every available credit, we help you improve profitability with no upfront cost.

$9.6k

Maximum tax credit per eligible new hire

15%

Average percentage of new hires that qualify for WOTC

$650M

Total WOTC credits identified for our clients

WORK OPPORTUNITY TAX CREDIT

Skip the paperwork. Cash your credits.

For industries like staffing, construction, and home healthcare, high-volume hiring is essential, but it puts constant pressure on already slim margins. WOTC is designed to reward employers for hiring disadvantaged job seekers, but taking advantage of it can be an administrative nightmare.

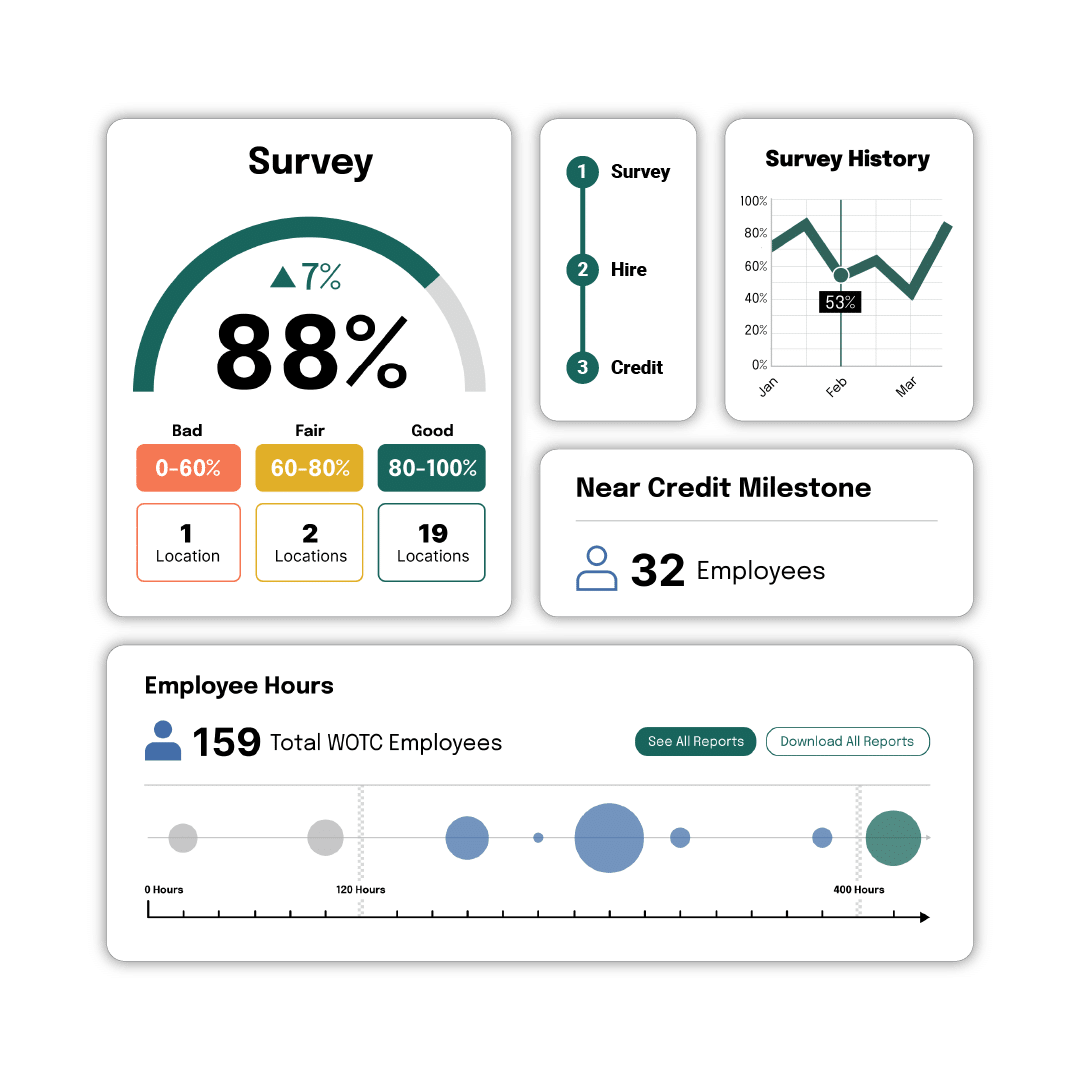

Arvo’s suite of intuitive WOTC tools delivers a better way: an eligibility survey integrated directly into your onboarding process, a real-time optimization dashboard, and a team of experts advocating with state and federal agencies on your behalf.

Gain full visibility into your savings and performance with a real-time optimization dashboard

Maximize your tax savings by capturing every eligible WOTC credit

Eliminate administrative burdens with our automated screening and government form submission.

Integrate WOTC screening into your existing onboarding workflow

Hire with confidence knowing our experts are handling compliance, tracking, and audit support.

EXPLORE EVERYTHING ARVO OFFERS

R&D

The government wants to pay you for spending on research and development. Let them.

Bookkeeping

Perfect financials—on time, every time.

Tax Planning

Don’t just file. Know you’re capitalizing on every available opportunity.

Bundle

Build a holistic tax strategy. Achieve your goals.

Confusing forms and missed deadlines?

Useless reports?

Grow cash flow

WOTC provides a substantial cash flow boost directly to your bottom line. By turning a standard business operation into a revenue source, you can reinvest savings back into your company’s growth.

Risk-free profits

With no upfront costs and fees based only on the credits we secure for you, WOTC is a purely additive source of revenue. We turn a compliance headache into a hands-off boost to your bottom line.

Specialists for any industry

Tech

Up to $9,600 tax credit per hire helps

you scale your team and lower

talent acquisition costs.

Manufacturing

16% of new hires qualify on average,

providing tax savings of over

$2,100 per employee.

Engineering

$2,400 average credit per hire helps

you affordably grow your team to

take on bigger projects.

Medical

20-25% of new hires may qualify,

significantly reducing the staffing costs

of your growing practice.

Construction

15-25% of new hires qualify, turning

your hiring process into a direct boost

for your bottom line.

Architecture

Up to $9,600 per hire allows you to

expand your talent search without

expanding your budget.

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks

Stop leaving money on the table

Turn your standard hiring process into a valuable financial advantage.