Learn how your Work Opportunity Tax Credit performance measures up

Whether you’ve been around the block a few times with the Work Opportunity Tax Credit (WOTC), or you are just beginning to implement it, it’s always worthwhile to assess your program’s performance. After all, optimizing your program can result in profits multiplied more than 600%!

We conduct complimentary WOTC audits for companies who have questions such as:

- Is my WOTC program performing well?

- Am I earning as much with WOTC as I should?

- What could I do to earn more with WOTC?

- How much do top WOTC earners make?

In this blog, we’ll give you all the information you need to perform a self-audit…or you can skip the legwork by giving us a call for a complimentary in-depth audit now!

WOTC KPIs

Auditing a WOTC program involves measuring three key performance indicators. Quick definitions follow. Click each definition for more information.

- Certification rate: The percentage of positively-screened new hires who receive WOTC certification from a state workforce agency

- Retention rate: The percentage of WOTC-certified new hires who maximize their credit potential by surpassing hours-worked milestones

Collect your KPIs before proceeding.

Arvo’s WOTC dashboard makes it easy for businesses of all sizes to identify and analyze these (and more!) WOTC KPIs.

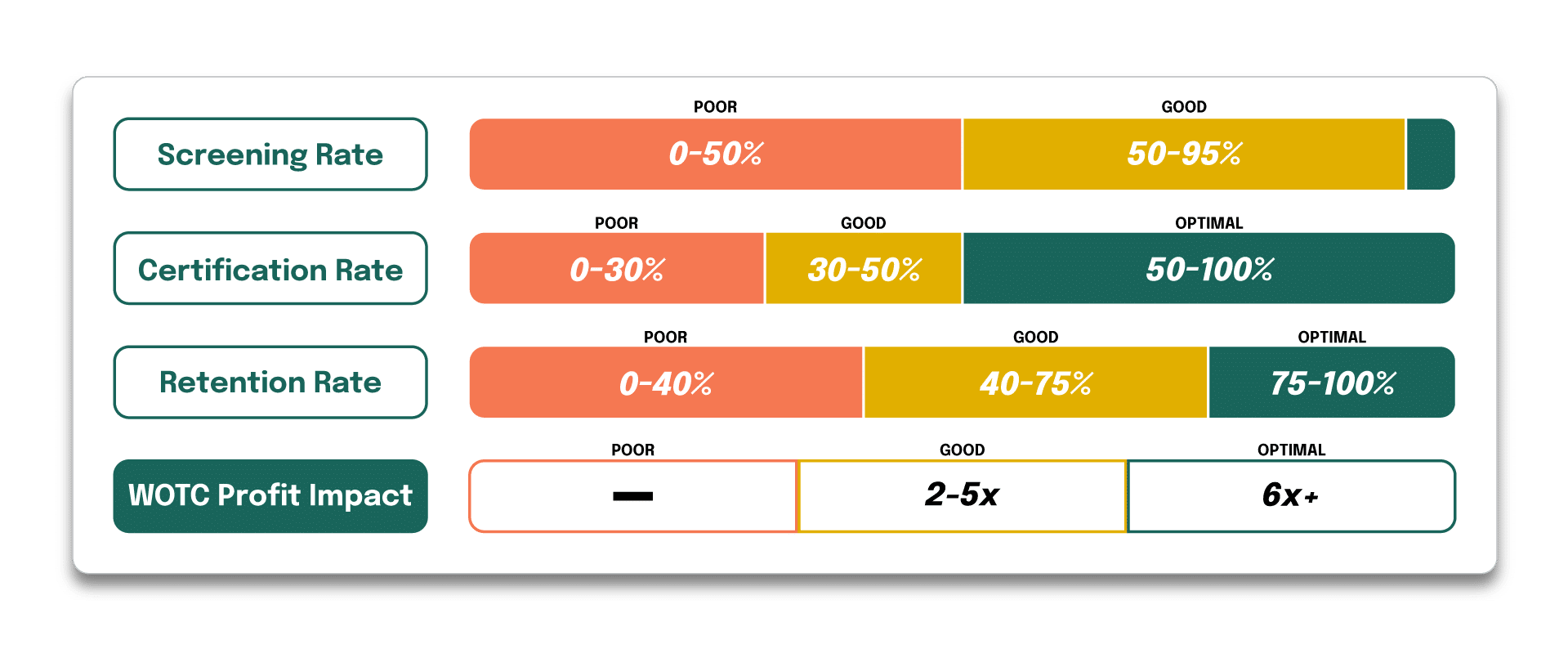

Performance ranges

The chart below gives ranges for each of the key performance indicators, organized from “poor” to “optimal.” Place your KPIs on this chart to assess your program’s performance.

Arvo builds customized tools and solutions to improve any business’s WOTC performance. Check out our case studies for real examples.

Self-audit

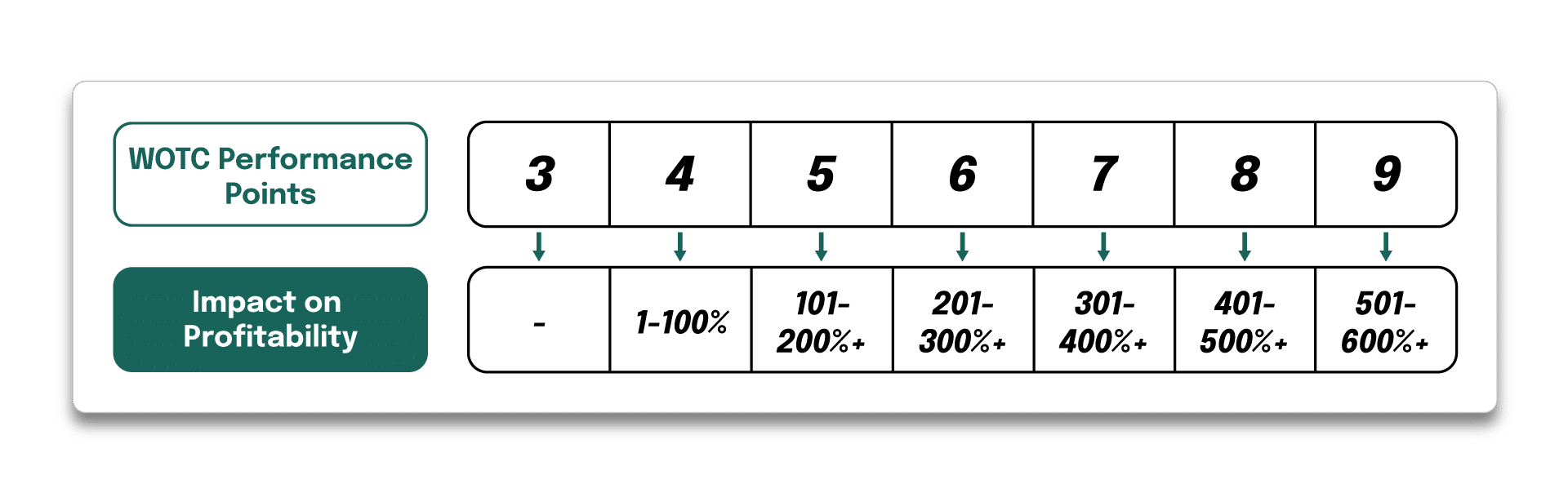

To determine the impact of your WOTC KPIs on your overall profitability, translate your performance into the points system explained below.

- For each KPI that falls into the “Poor” range in the chart above, give your program one point.

- For each that falls into the “Good” range, give two.

- For KPIs in the “Optimal” range–three points.

What’s your point total? The chart below translates your current WOTC performance into potential profitability as compared to a poor-performing program.

Is WOTC worth it?

You’re a business owner or decision maker. We understand that your choice of who to trust with taxes and finances is a high-stakes decision.

We ourselves are a small business founded by tax professionals who sought to extend the tax benefits big companies enjoy to businesses of all sizes.

If you’re asking whether or not WOTC is worth it, consider that our fee structure is 100% contingent on your profits–so, simply put, our business would not exist if WOTC wasn’t worth it.

Whether you’re brand new to WOTC, or seeking to get more than your current servicer offers, we can deliver transformative profits.

Contact us today.