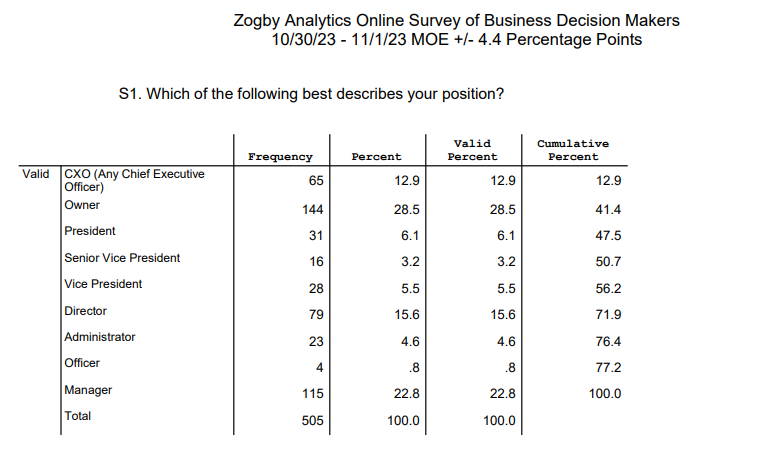

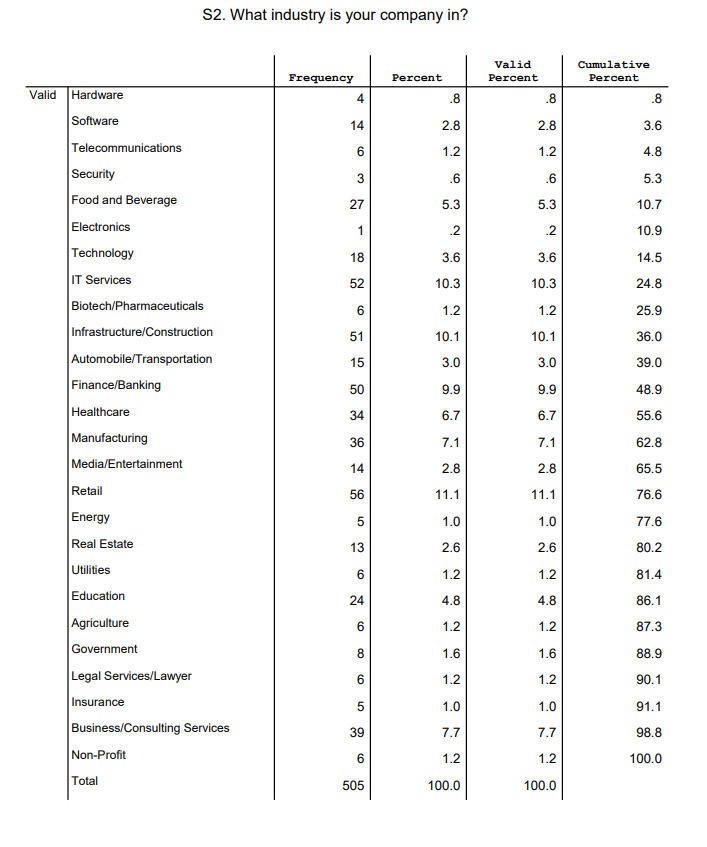

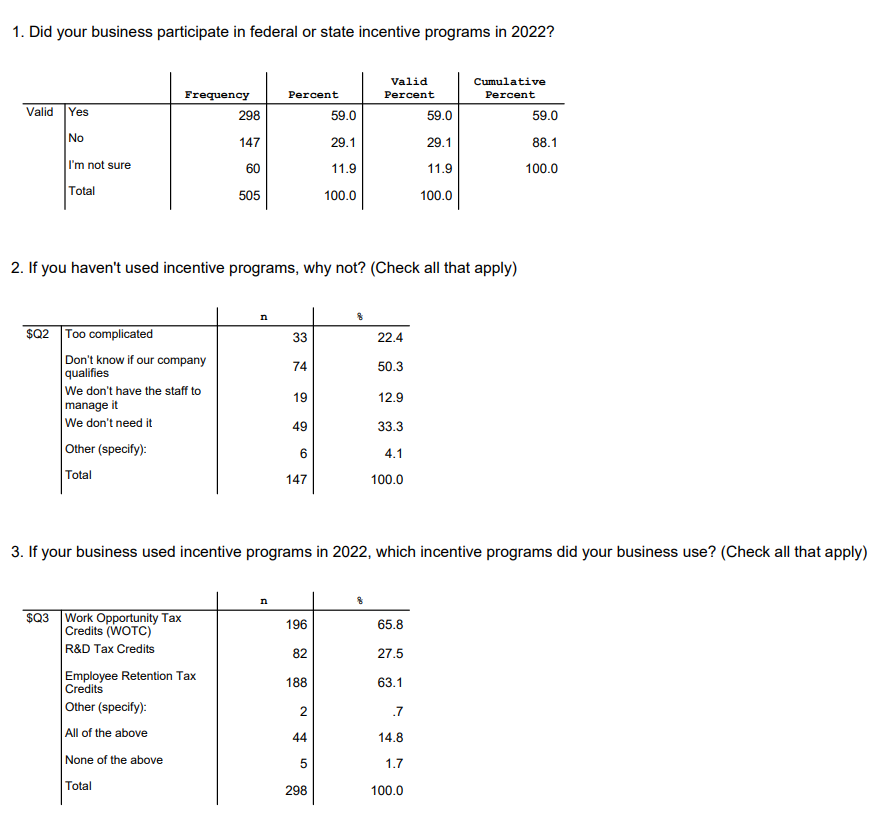

This year has been a turbulent time for business owners, with inflation, rising interest rates and a volatile economy. To combat losses and help support growth, more small and mid-sized businesses (SMBs) participated in federal and state incentive programs this year, according to a new study from Arvo Tech, the leading technology platform that helps businesses unlock the full value of employment tax credit programs. The survey of 500 SMB business decision makers was conducted by Zogby Analytics and found that 59 percent of U.S. SMBs participated in federal and state incentive programs in 2022, an increase of 14 percent year-over-year.

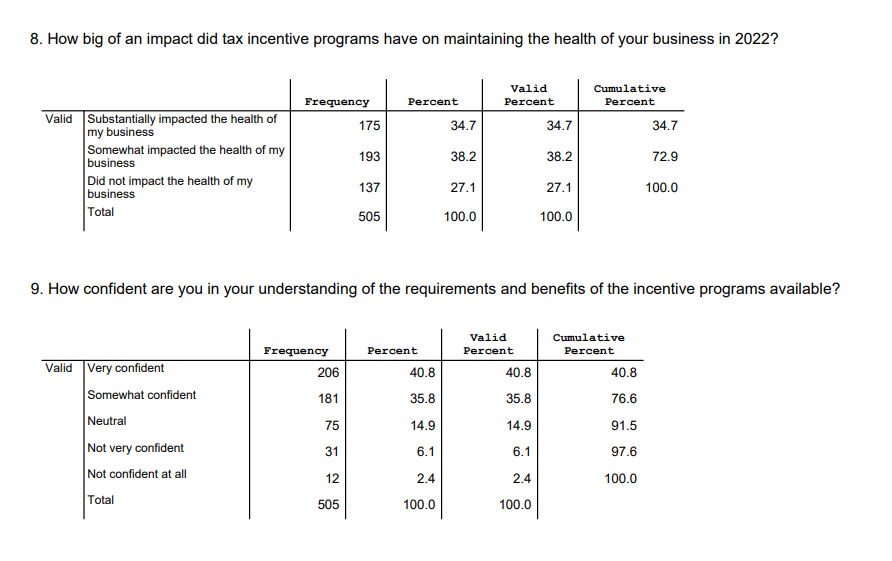

Almost three-quarters of businesses reported that tax incentive programs have impacted the health of their businesses in 2022 – with more than one-third saying the impact has been substantial. The Work Opportunity Tax Credit remains the most popular incentive program for SMBs with 66% of respondents saying they applied for it – an increase of nearly 12% year-over-year. More than six in 10 businesses leveraged the Employee Retention Tax Credit – up 44% since last year.

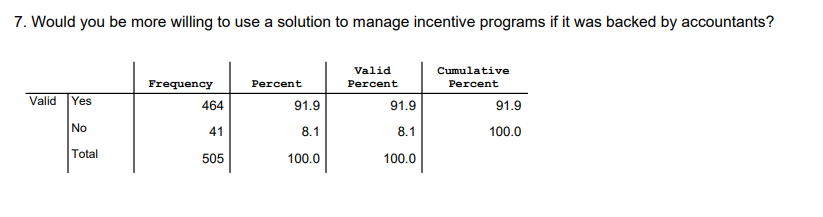

According to the survey, half of the businesses that did not use incentive programs in 2022 said it was because they weren’t sure if their companies qualified. Nearly every SMB polled (91%) say they want to work with accountant-backed solutions, while another 20 percent are interested in automated platforms for managing incentive programs.