Oct 29, 2025 | Uncategorized

Learn how to cut taxes, build wealth, and keep great employees Retirement plans aren’t just about retirement. If you’re a business owner, they’re one of the most overlooked tools for cutting your tax bill, building long-term wealth, and making your business more...

Oct 29, 2025 | Uncategorized

Why budgeting isn’t enough It’s a familiar story for many business owners: you diligently set money aside for taxes throughout the year, maybe a fixed percentage of your revenue. You think you’re prepared. Then, tax season hits, and the actual bill is far higher than...

Oct 29, 2025 | Uncategorized

These best practices reduce audit risk, and give business owners peace of mind Few words strike more unease into a business owner than “IRS audit.” The thought alone can be stressful, imagining a deep dive into your financials and the potential for penalties. Let’s be...

Oct 29, 2025 | Uncategorized

Why investing in expert bookkeeping saves time & money Every business owner expects to pay for bookkeeping, whether it’s software, a part-time bookkeeper, or a full-service accounting firm. But the real cost of bookkeeping isn’t just the invoice you receive—it’s...

Oct 29, 2025 | Uncategorized

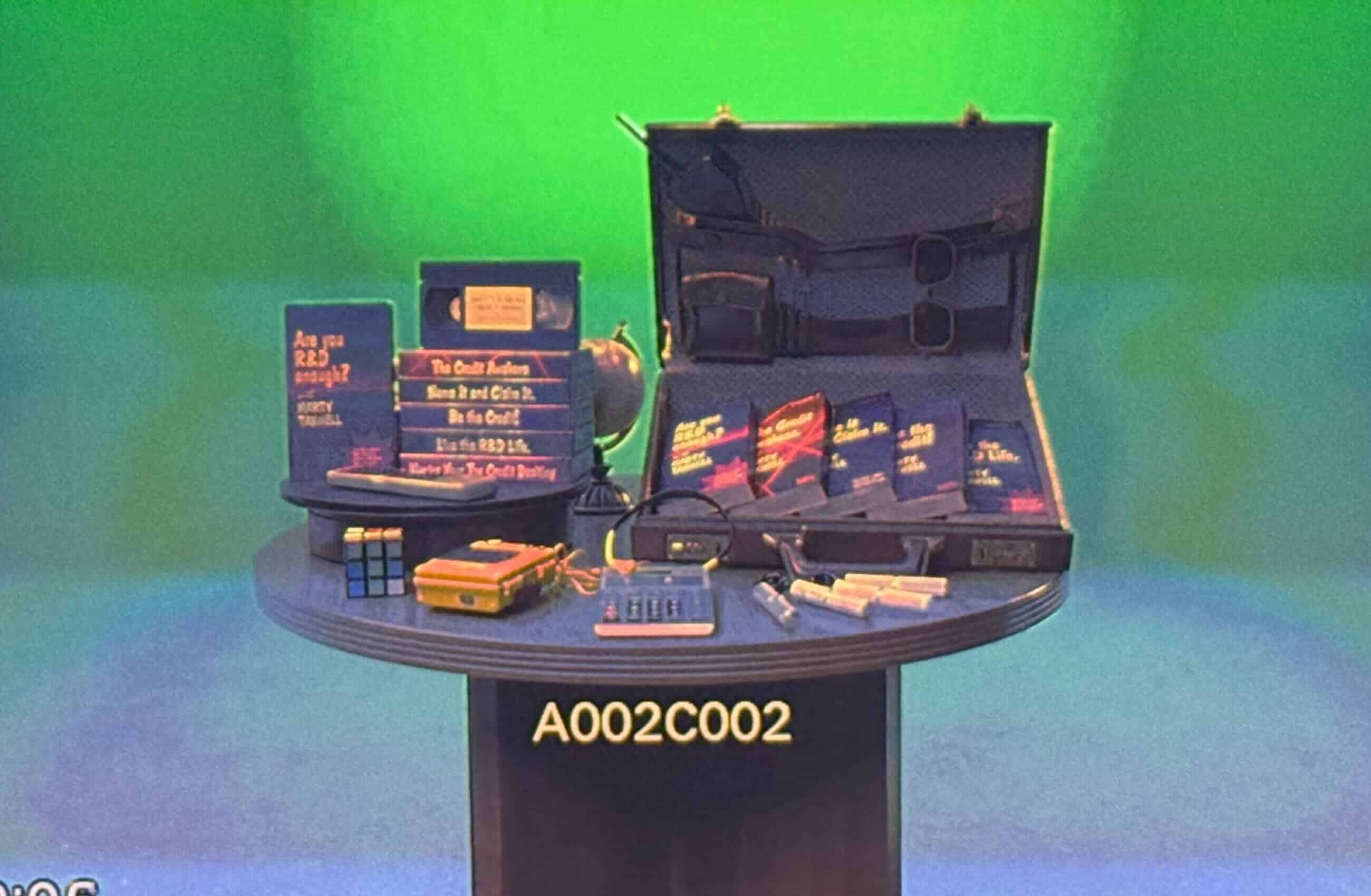

How tax credits can lower your business costs If you’re a small business owner, you already know taxes are one of your biggest expenses. What you might not know? You could be paying more than you have to. Tax credits are one of the most effective ways to reduce your...

Oct 29, 2025 | Uncategorized

Protect your bottom line with proactive planning From materials and supplies to wages, inflation is making it harder for many small and mid-sized businesses to keep their footing. The good news is smart tax planning can help ease some of the financial strain your...