Some “low-risk” claimants should expect checks “soon”

Nearly four and a half years since the bill creating the Employee Retention Tax Credit (ERTC) was signed, entitling qualifying American businesses to refundable tax credits for paying employees through COVID shutdowns, the IRS announced this month (on August 8 and August 15) that it is “accelerating” processing of claims.

This announcement follows last September’s processing moratorium on new claims, due to the unexpected workload created by the program and accusations of fraudulent claims. Slow processing has left millions of American businesses waiting for funds promised to help them recover from detrimental economic impacts of government-ordered shutdowns.

This blog summarizes and contextualizes what businesses owners should know now regarding their ERTC claim.

How we got here

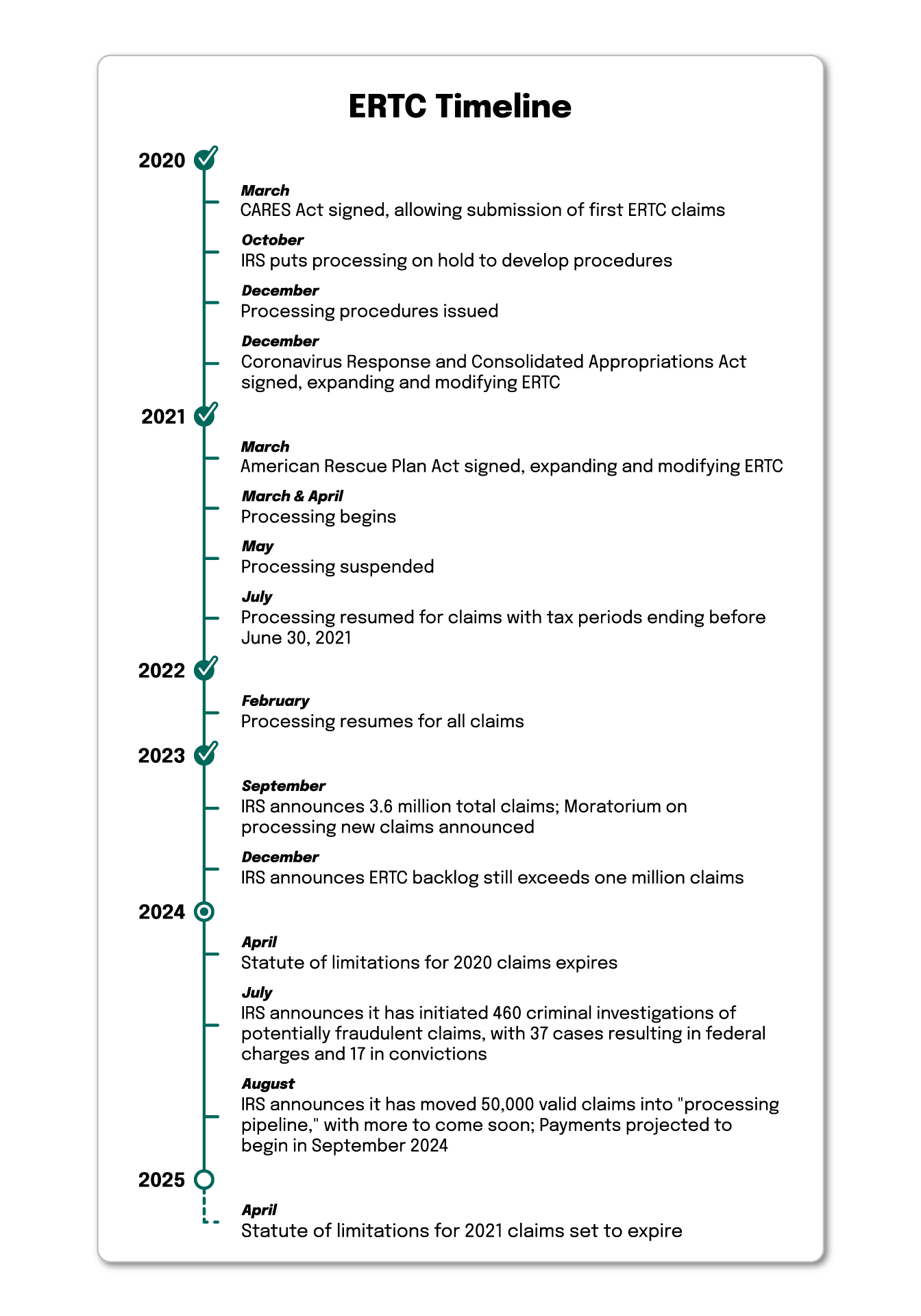

The timeline below summarizes congressional and bureaucratic activity related to the processing of ERTC claims.

Where we are

The August 2024 IRS announcements about the ERTC confirm that the agency has resumed processing claims. It also claims that the agency has issued 28,000 disallowance letters to “high-risk” claims as a result of its investigations into fraud. They have also established an appeal process for recipients of disallowance letters who believe their claim to be valid. Arvo has communicated with all of its clients the importance of notifying us of any communication received from the IRS regarding their ERTC claim. We fully support the validity of our clients’ claims, from the beginning to the end of the claim process.

The IRS also confirmed that 50,000 “low-risk” claims have been moved into a “processing pipeline” and will be “paid out quickly.”

Finally, they announced that they will begin “judiciously processing” claims submitted after the September 14, 2023 moratorium date.

What to expect

We understand that your ERTC funds are important. Because of this, our team regularly contacts the IRS to request updates on our clients’ claims. If you would like to directly request an update on the status of your claim, instructions for doing so are explained here.

Unfortunately, many businesses with valid claims remain in limbo. Estimates vary widely regarding how long it will take to receive an ERTC refund. If we’ve learned anything from the process so far, it is that no one should count on receiving their refund on a hard timeline.

That being said, two factors may affect your claim’s processing speed: 1) the size of your claim, and 2) the date it was received by the IRS. It is reasonable to expect that larger claims will be subject to more scrutiny, and thus face longer wait times. It is also reasonable to expect that the IRS will process ERTC claims roughly in the order in which they were received, although it should be noted that they have announced they will prioritize “high-risk” and “low-risk” claims first.