TECH

Hand off your financial backend

Tech companies face unique financial hurdles that can slow momentum and kill investor confidence. Arvo manages this complexity with precision, providing the financial discipline and strategic insight you need to scale confidently.

Achieve ASC 606 compliance for accurate revenue recognition

Gain clear visibility into MRR, ARR, burn rate, and runway

Maximize your runway with powerful R&D tax credits

Stay investor-ready with pristine, diligence-proof financials

Reclaim leadership time to focus on product and growth

R&D

The government wants to pay you for spending on research and development. Let them.

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax planning

Don’t just file. Know you’re capitalizing on every available opportunity.

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

From seed to scale

We partner with tech companies for the long haul, providing the financial infrastructure they need to navigate funding rounds and achieve sustainable growth. The numbers speak for themselves.

80%

Percentage of our total client base in tech

R&D

Most overlooked tax credit for Tech clients

$389,600

Average R&D tax credit claim for tech companies

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

Bookkeeping for core metrics

Don’t let inaccurate or delayed financials derail investor conversations or strategic planning. Arvo delivers the pristine, real-time data tech companies demand. Gain an undisputed single source of truth for MRR, churn, CAC, and runway, empowering you to confidently drive growth, secure funding, and scale with precision.

Turn dev sprints into cash

Tech finance experts

Meet the team dedicated to your company’s financial health. Our experts understand the nuances of the tech industry, from SaaS metrics to equity compensation, providing the clarity you need to scale.

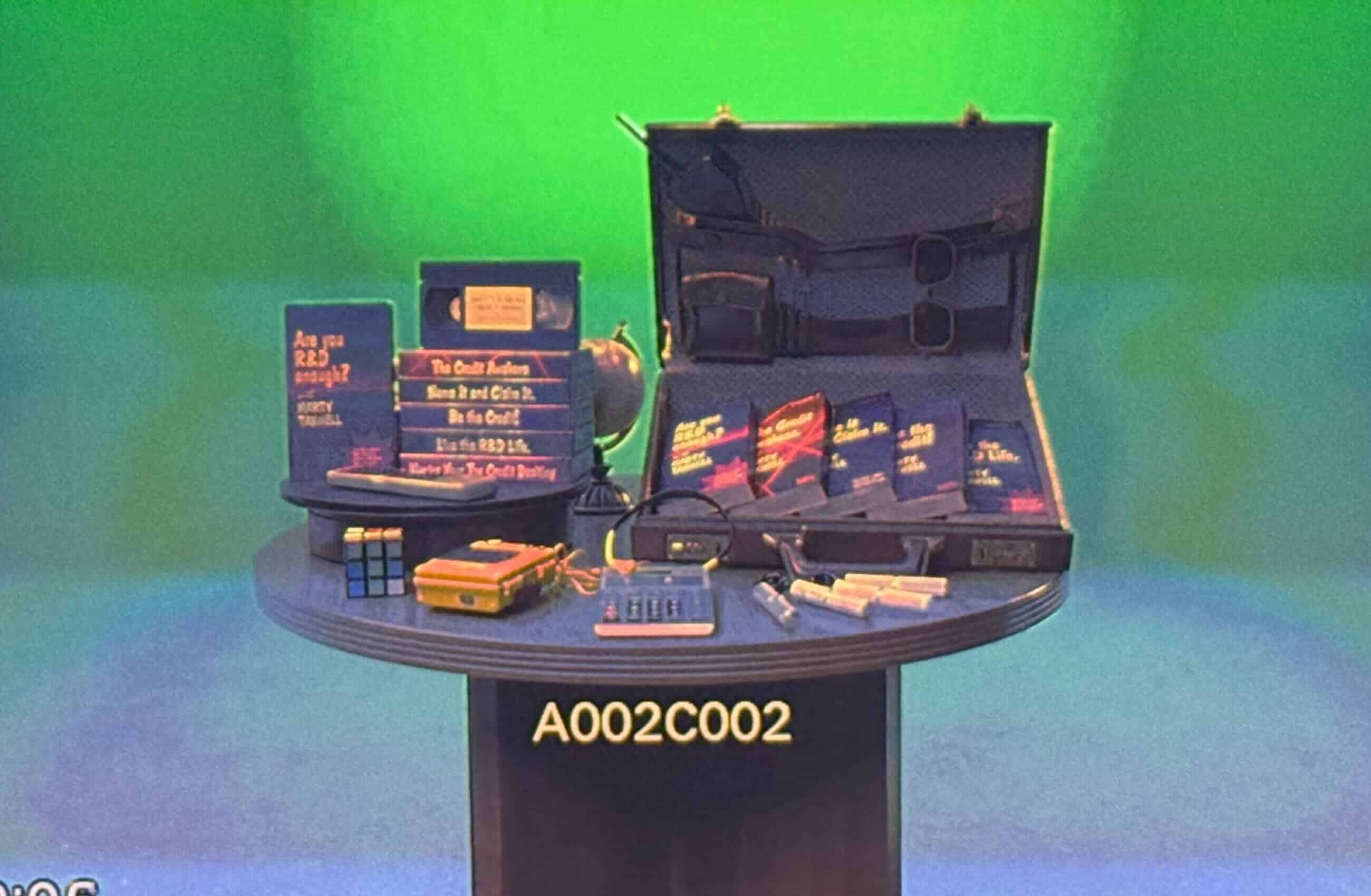

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on your federal taxes for hiring new employees from diverse backgrounds. The process is simple and rewarding.

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks

What’s your growth strategy?

Join over 5,000 businesses that have trusted their tax and accounting with Arvo.

How do you handle complex revenue recognition like ASC 606 for SaaS?

This is one of our core specialties. We manage the entire process, implementing proper controls for deferred revenue and recognizing it over the life of the customer contract. Our approach ensures you are fully ASC 606 compliant, providing accurate, GAAP-compliant financial statements that give you and your investors a true picture of your company’s performance.

Can we really get R&D tax credits for software development?

Absolutely. The R&D tax credit is specifically designed for activities like software development. Qualifying expenses include developer wages, costs for contractors, and supplies used in the process of creating new or improved software, platforms, or algorithms. Our specialists have helped tech companies claim millions in credits for work they were already doing.

We're preparing for our next funding round. How can you help?

We act as a key part of your fundraising team. We ensure your financials are pristine, investor-ready, and can withstand the rigors of due diligence. We provide accurate historical statements, help prepare financial models and forecasts, and ensure your key metrics (MRR, LTV:CAC, Churn) are solid and defensible, giving investors confidence.

We use Stripe, Gusto, and other platforms. How do you integrate?

Our tech-powered platform is built to integrate seamlessly with the modern tech stack. We connect with payment processors like Stripe, payroll providers like Gusto, and expense management tools to automate data flow. This reduces manual work, eliminates errors, and gives us a real-time, comprehensive view of your financial operations.