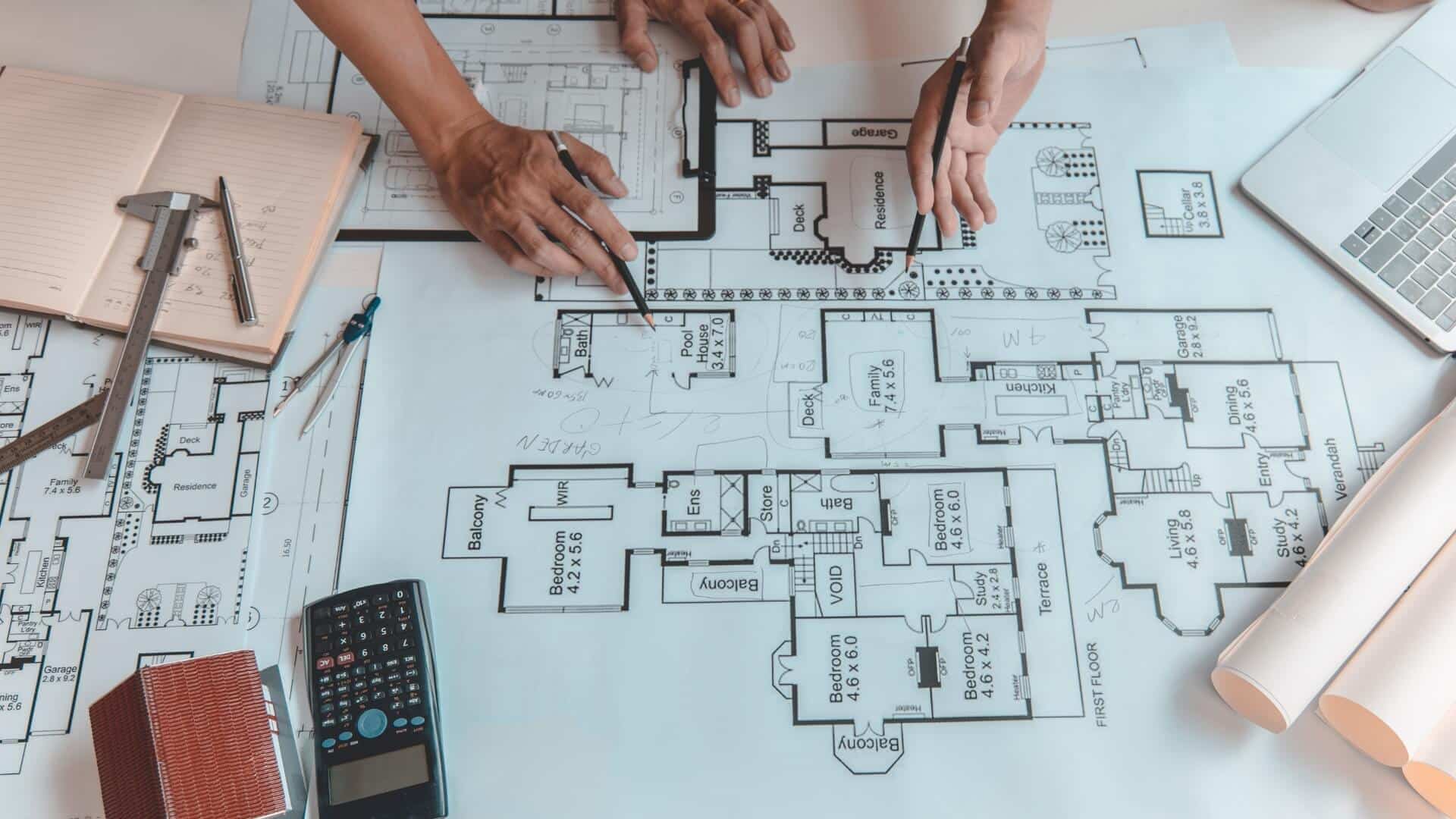

ARCHITECTS

Focus on schematics, not spreadsheets

Architecture firms face unique financial challenges, from unpredictable cash flow to intricate job costing. Arvo handles this financial complexity with precision, providing the structure and insight you need to build a more profitable and resilient practice.

Track profitability for every single project

Improve cash flow with accurate, timely billing and expense management

Capture powerful R&D tax credits for your innovative design work

Reclaim billable hours to focus on clients and design

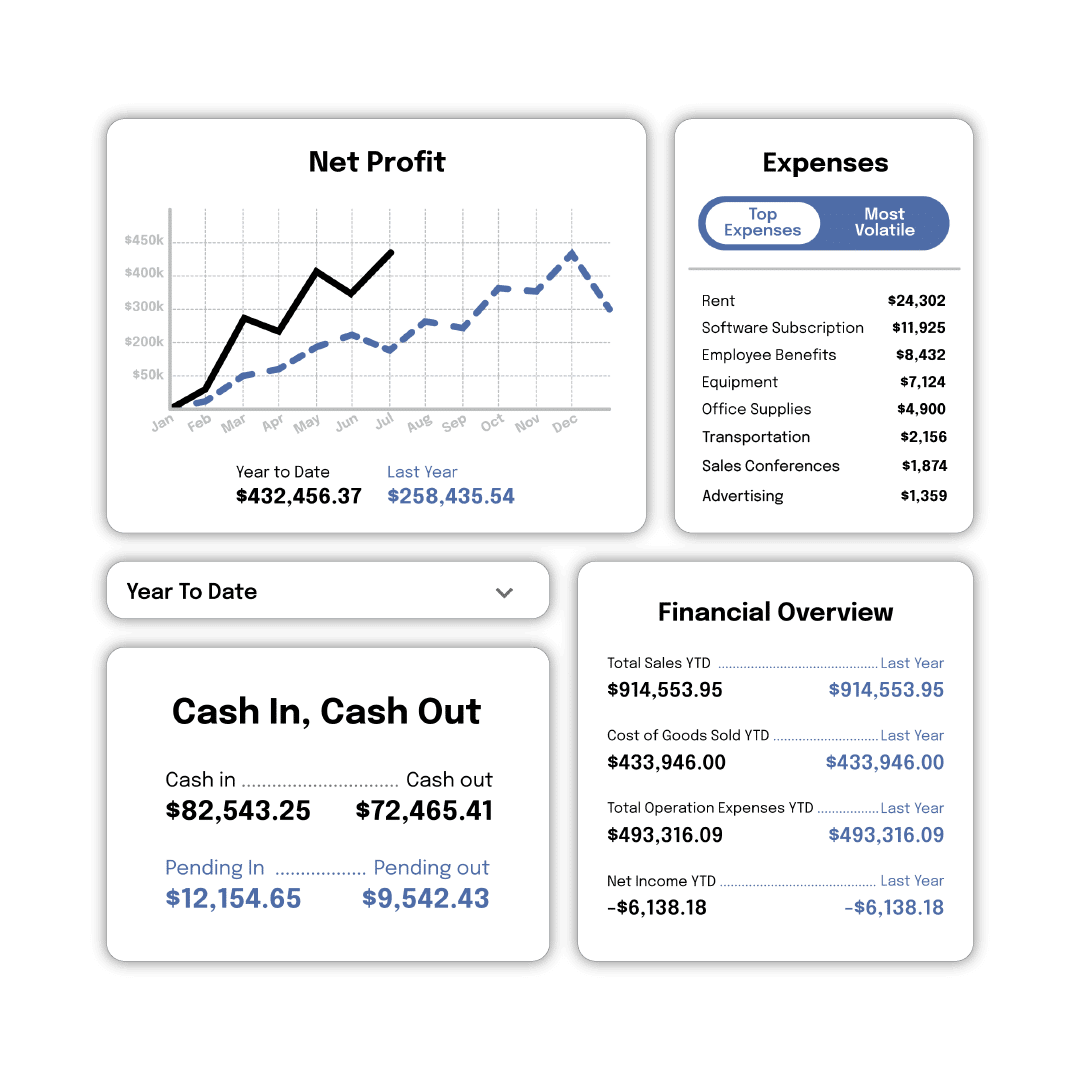

Make better decisions with clear, timely financial data

R&D

The government wants to pay you for spending on research and development. Let them.

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax planning

Don’t just file. Know you’re capitalizing on every available opportunity.

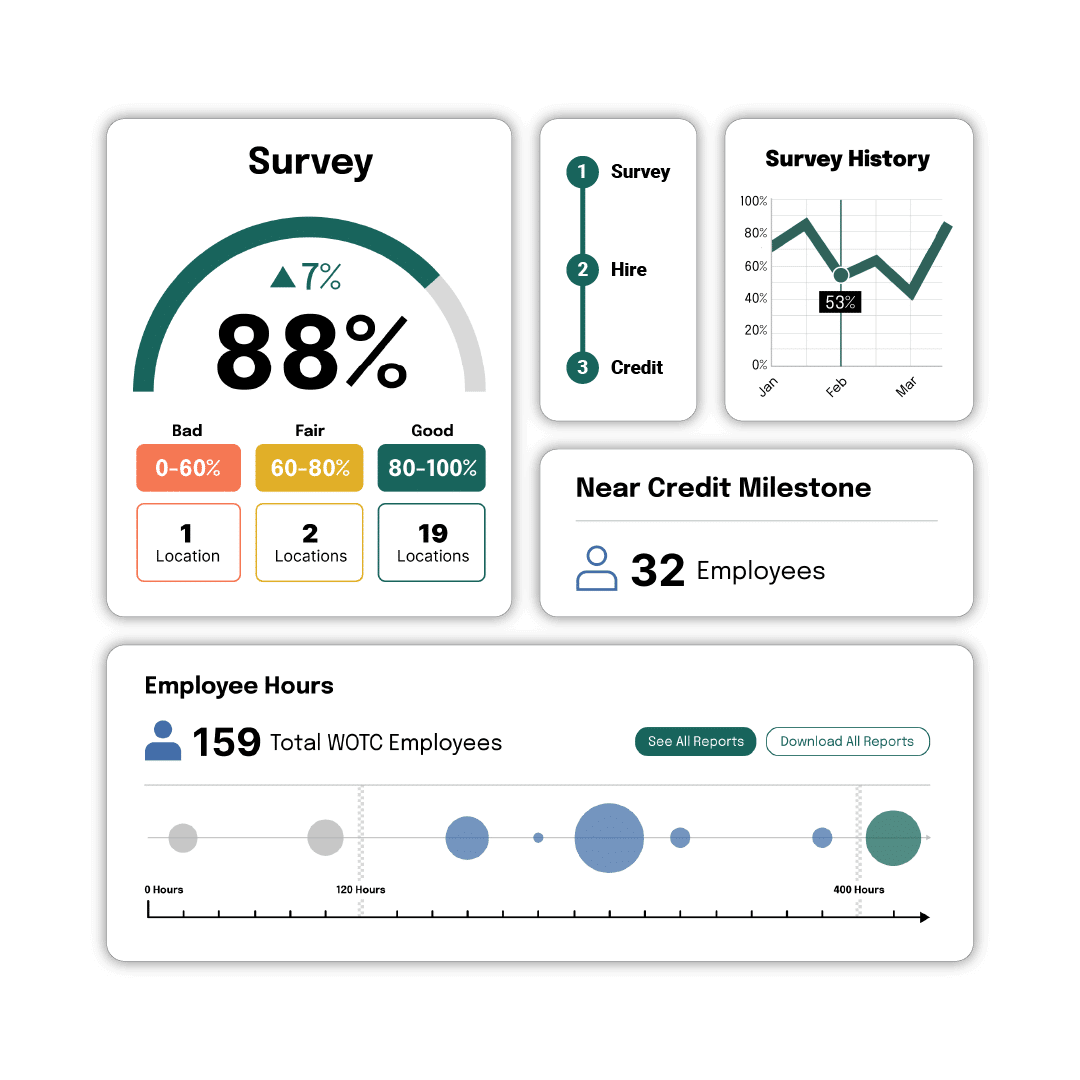

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

Build a firm that endures

We partner with architecture firms for the long term, providing the financial foundation they need to grow from a boutique studio to an industry leader. The numbers speak for themselves.

2023

Year of landmark case establishing architecture’s eligibility for R&D tax credits

0

Number of our architecture clients who knew they qualified for R&D

$203,750

Average R&D tax credit claim for architecture firms

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

Bookkeeping for better bids

Tax credits for innovative design

Your firm’s creativity in developing unique building methods, sustainable materials, or energy-efficient systems isn’t just design—it’s R&D. Arvo specializes in identifying qualifying architectural innovation, translating your technical challenges and design process into substantial R&D tax credits and significant cash back for your firm.

Architecture finance experts

Meet the team dedicated to your firm’s financial health. Our experts understand the nuances of the architecture industry and provide the clarity you need to build a more profitable practice.

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on your federal taxes for hiring new employees from diverse backgrounds. The process is simple and rewarding.

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks

What’s your growth strategy?

Join over 5,000 businesses that have trusted their tax and accounting with Arvo.

Our firm's revenue can be unpredictable. How do you manage that?

We specialize in financial management for project-based businesses. Our services are designed to help smooth out lumpy revenue cycles by providing accurate cash flow forecasting, optimizing your billing processes, and delivering clear monthly reports. This gives you the visibility to manage expenses and make strategic decisions, even when revenue fluctuates.

What kind of architectural work qualifies for the R&D tax credit?

Many common architectural activities can qualify. This includes developing unique, energy-efficient building designs, creating innovative construction or fabrication techniques, integrating new materials in your plans, or improving functional designs through modeling and testing. Our specialists will analyze your projects to identify and document all qualifying activities to maximize your claim.

How do you handle project accounting and job costing?

This is central to our service for architects. We track expenses, labor, and revenue on a per-project basis, providing you with detailed job costing reports. This allows you to monitor the profitability of each project in real-time, identify potential budget overruns early, and use historical data to create more accurate and competitive bids for future work.

We use specific industry software for project management. Can you work with it?

Yes. Our tech-powered platform is designed to be flexible and can integrate with a wide range of industry-specific software used by architecture firms. This ensures a seamless flow of data, reduces manual entry, and allows us to provide you with a comprehensive financial picture that combines your operational data with your accounting data.