“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

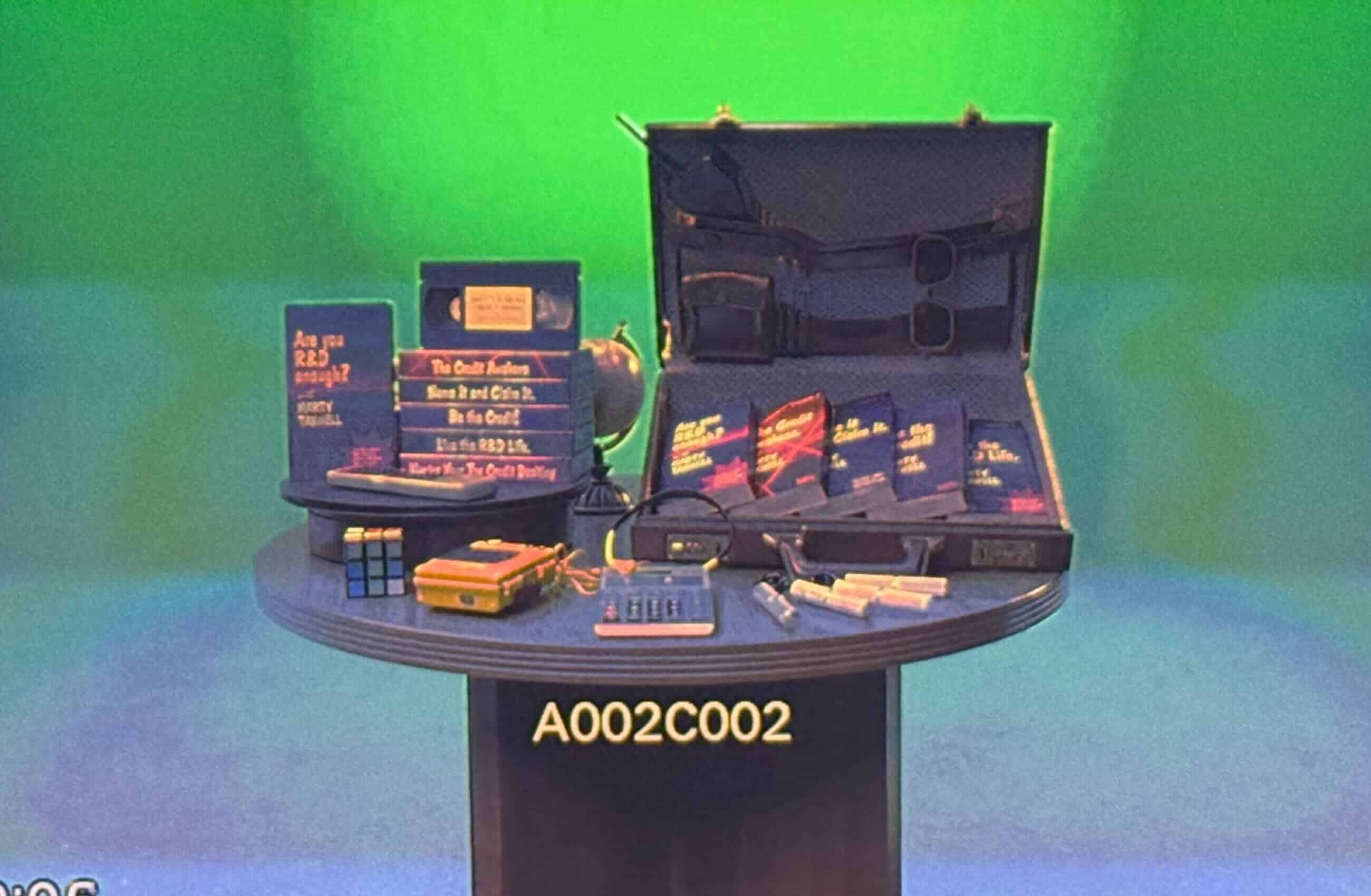

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

Reclaim your time

Grow your margins

Four part test

Does your business qualify for R&D tax credits?

ROI don’t lie

$1,000,000,000+

Total tax credits we’ve claimed for our clients

$0

Total tax credits disallowed by the IRS

12

Average weekly hours we save SMB leaders through bookkeeping

300%

Improvement in cash flow one client saw thanks to our WOTC services

500%

Average dollar-for-dollar ROI for our R&D clients

99th

Percentile for our NPS score, measuring how many clients would recommend us

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

How Architecture & Engineering Firms Can Capitalize on New R&D Tax Laws

Join our tax experts on November 20, 2025 at 2:00 PM EST to beat the R&D rush.