A better financial partner, by design

C-suite vision

Our financial strategies are born from executive leadership, delivering a higher level of guidance than traditional services.

Human in the loop

Technology does the heavy lifting; our experts provide the wisdom. A dedicated strategist reviews your financials to catch what software misses and find opportunities for growth.

Insight oriented

We go beyond just cleaning up your data. We deliver a clear financial picture that helps you make smarter, faster decisions about your business.

History

2014

Arvo is launched in Columbus, Ohio, by Terracina Maxwell and Brent Johnson to bring tax credits to small businesses.

2020

Arvo delivers over $650 million in COVID relief to SMBs through the Employee Retention Tax Credit.

2024

Arvo expands its operations by acquiring two full-service accounting firms and a specialty tax credit servicer.

2025

Successful fundraising leads to expansion, enabling Arvo to deliver a full suite of tax and accounting services at scale.

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

A former Deloitte professional, Brent also brings executive tax leadership experience from Safelite.

A proven leader, Eric brings extensive CEO and CRO experience from scaling market-disrupting SaaS companies.

Following years at Deloitte, Monika led complex corporate tax teams for over 15 years.

Ken leverages his deep experience leading marketing and product for multiple B2B SaaS organizations.

Todd brings over two decades of engineering and product leadership experience from scaling technology companies.

Emily drives growth by connecting clients with strategic tax solutions, thanks to her strong background in sales and marketing.

Paul oversees Arvo’s product vision, leveraging years of experience in product strategy and operations at leading tech firms.

A seasoned expert, Mark successfully led his own tax and accounting firm for over 30 years.

We tackle ambitious challenges and value the diverse perspectives each team member brings. If you’re ready to do the best work of your career in a culture that encourages you to be your authentic self, let’s connect.

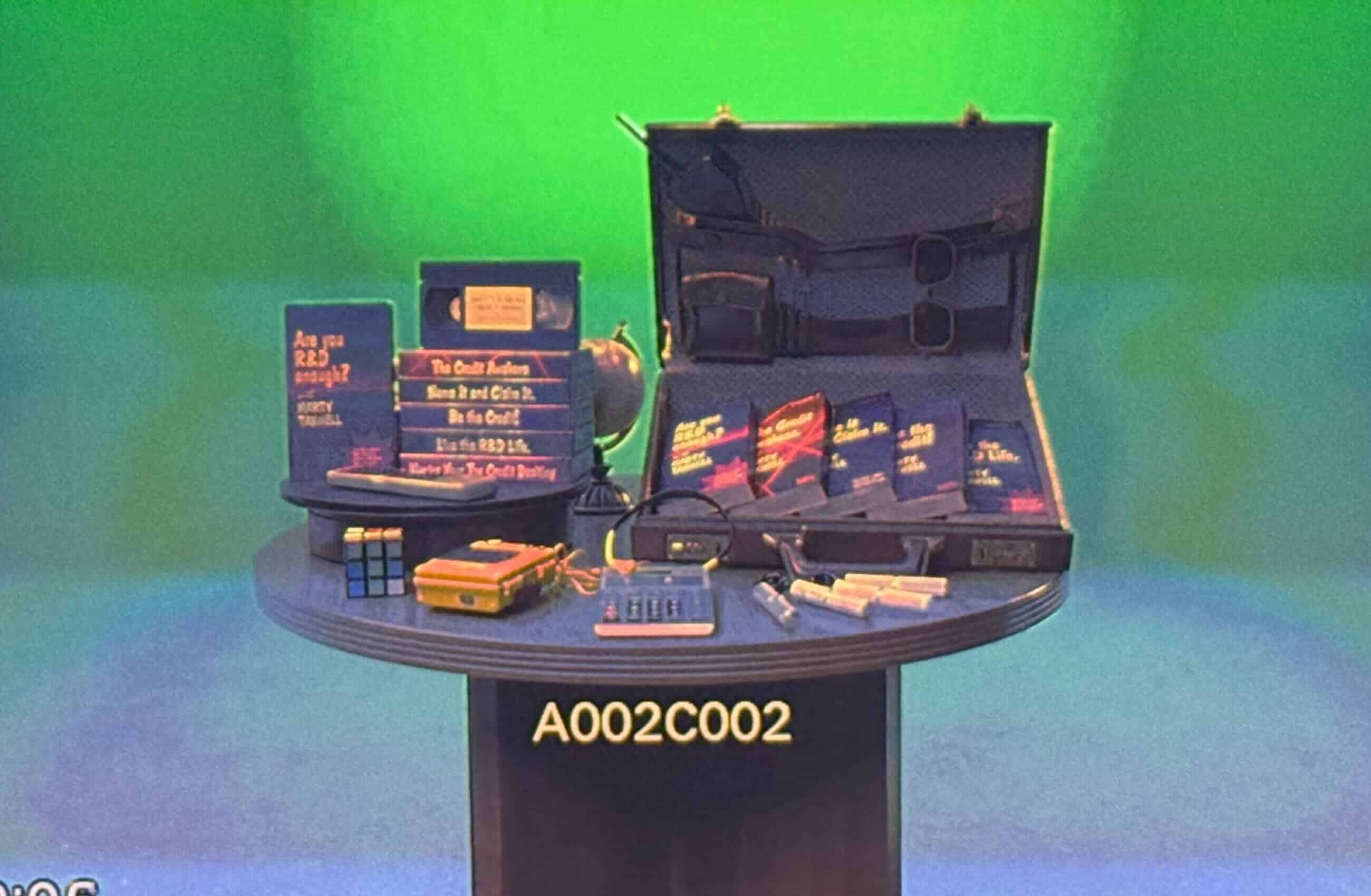

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks