Hospitality Industry

Decline in revenue and government shutdown leads to ERTC Eligibility for Hotel

Many hotels have experienced significant declines in revenue during the COVID-19 crisis. An even larger percentage of hotel restaurants were required to shut down for some time.

The financial impact from either scenario can unlock significant benefits through the Employee Retention Tax Credit program.

Part 1

The Challenge

Government restrictions lead to decline in revenue

Due to the decline in travel early in the COVID-19 pandemic, a hotel had significant decline in gross receipts. In addition, the restaurant on premises was subject to restrictions in service because of government mandates.

Part 2

The Problem

Confusion around ERTC eligibility and Interaction with PPP

As the COVID-19 crisis evolved, rule changes in the ERTC program and the required coordination with PPP loan forgiveness made it unclear whether the hotel including the restaurant qualified for the ERTC. There was additional confusion around the period for which they may qualify and whether claiming it would negatively impact their PPP loan forgiveness.

Part 3

The Solution

Arvo identifies eligibility due to the impact of COVID-19

After talking with the tax experts at Arvo, the hotel and restaurant owner discovered that they were eligible for the ERTC as a result of experiencing a partial shutdown due to government mandates within the restaurant, along with a decline in gross receipts from the hotel.

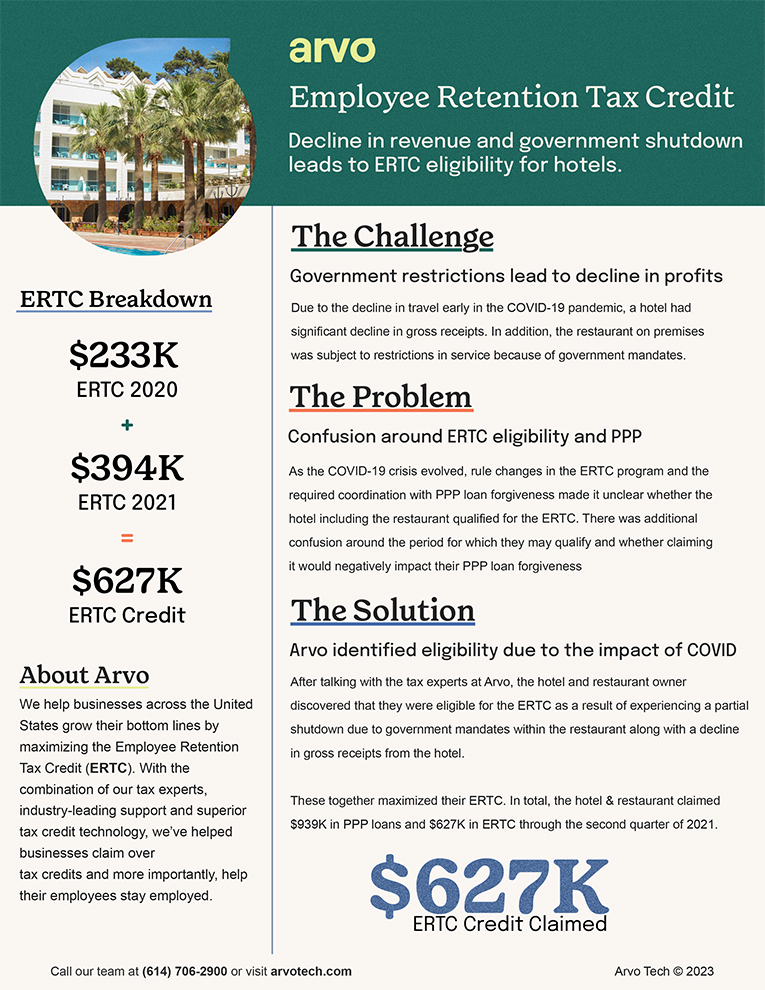

These together maximized their ERTC. In total, the hotel & restaurant claimed $939K in PPP loans and $627K in ERTC through the second quarter of 2021.

ERTC Credit Claimed

Get started today.

Hospitality Industry

Decline in Revenue and Government Shutdown lead to ERTC Eligibility for a Hotel

Many hotels have experienced significant declines in revenue during the COVID-19 crisis. An even larger percentage of hotel restaurants were required to shut down for some time.

The financial impact from either scenario can unlock significant benefits through the Employee Retention Tax Credit program.

The Challenge

Government Restrictions lead to decline in revenue

Due to the decline in travel early in the COVID-19 pandemic, a hotel had a significant decline in gross receipts. In addition, the restaurant on premises was subject to restrictions in service because of government mandates.

The Problem

Confusion around eligibility and interaction with PPP

As the COVID-19 crisis evolved, rule changes in the ERTC program and the required coordination with PPP loan forgiveness made it unclear whether the hotel, including the restaurant, qualified for the ERTC. There was additional confusion around the period for which they may qualify and whether claiming it would negatively impact their PPP loan forgiveness.

The Solution

Arvo identified eligibility due to the impact of COVID-19

After talking with the tax experts at Arvo, the hotel and restaurant owner discovered that they were eligible for the ERTC as a result of experiencing a partial shutdown due to government mandates within the restaurant, along with a decline in gross receipts from the hotel.

These together maximized their ERTC. In total, the hotel & restaurant claimed $939K in PPP loans and $627K in ERTC through the second quarter of 2021.

ERTC Credit Claimed