R&D fuels growth

By identifying and capturing every available credit, we help you improve profitability with no upfront cost.

$250k

Max payroll tax offset for qualified startups

80%

Percentage of companies that believe they do not qualify for the R&D Tax Credit,

but actually do

$800M

Total R&D credits identified for our clients

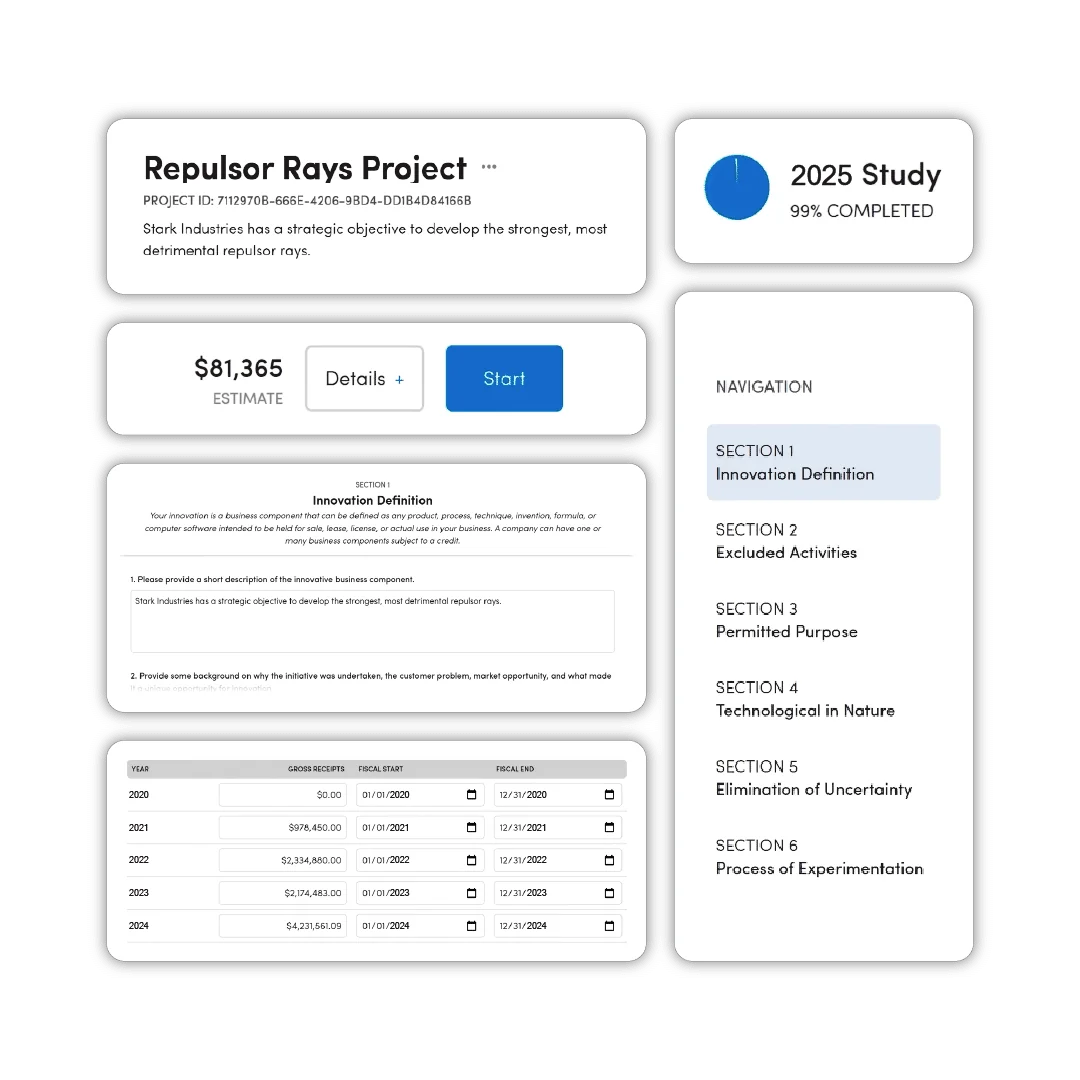

RESEARCH AND DEVELOPMENT (R&D) TAX CREDIT

Solve problems. Save on taxes.

Companies in software, manufacturing, and engineering constantly build new things, but the cost of this work often squeezes profits. The R&D Tax Credit helps businesses get money back for qualified research, but figuring it out can be a big headache.

Arvo offers a simpler way to get your R&D Tax credits with our expert-created platform. It’s easy to use, fits with your existing tools, and is smart enough to ensure you get all the credit you deserve.

EXPLORE EVERYTHING ARVO OFFERS

Bookkeeping

Perfect financials—on time, every time.

Tax Planning

Don’t just file. Know you’re capitalizing on every available opportunity.

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

Bundle

Build a holistic tax strategy. Achieve your goals.

Confused about qualification?

You don’t need a lab coat to qualify for the R&D credit. If you’re developing new or improved products, processes, or software, you likely qualify. Our experts help you apply the IRS’s Four-Part Test to your everyday activities to uncover the hidden value in your work.

Overwhelmed with documentation?

New or improved products

- Developing entirely new products or software applications

- Creating and testing prototypes and models

- Improving the function, performance, or reliability of existing products

- Designing new formulas or inventions

- And more

New or improved processes

- Developing new or improved manufacturing processes

- Designing and developing custom equipment

- Automating internal tasks or operational systems

- Improving quality control or testing procedures

- And more

Fund your innovation

BOOKKEEPING

Tech

Fewer than 30% of eligible SMBs claim

R&D credits, leaving billions in innovation funding unclaimed.

Manufacturing

61% of all R&D credits are claimed by

the manufacturing sector for process

and product improvements.

Engineering

qualifying R&D; we help you claim

it without risk.

Medical

medical and health R&D, creating

significant tax credit opportunities.

Construction

in credits construction firms earn

for everyday innovation.

Architecture

for architects, rewarding work you’re

already doing.

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“Our experience with the Arvo team was outstanding! We were not familiar with the R&D credit and felt the process would be cumbersome. The Arvo team was really knowledgeable, very responsive, and solutions-oriented.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks