STARTUPS AND SMALL BUSINESSES

The Internal Revenue Code is 4.5x longer than War and Peace

Focus on building your business, not 2.6 million words of tax code. We handle the details of compliance and financial management, allowing you to reclaim your time and concentrate on scaling your business.

Maximize savings with proactive tax and financial strategies

Ensure compliance with complex and ever-changing regulations

Gain visibility into your financial health

Reclaim valuable hours to focus on your products and customers

Access strategic guidance to make smarter, data-driven decisions

R&D

The government wants to pay you for spending on research and development. Let them.

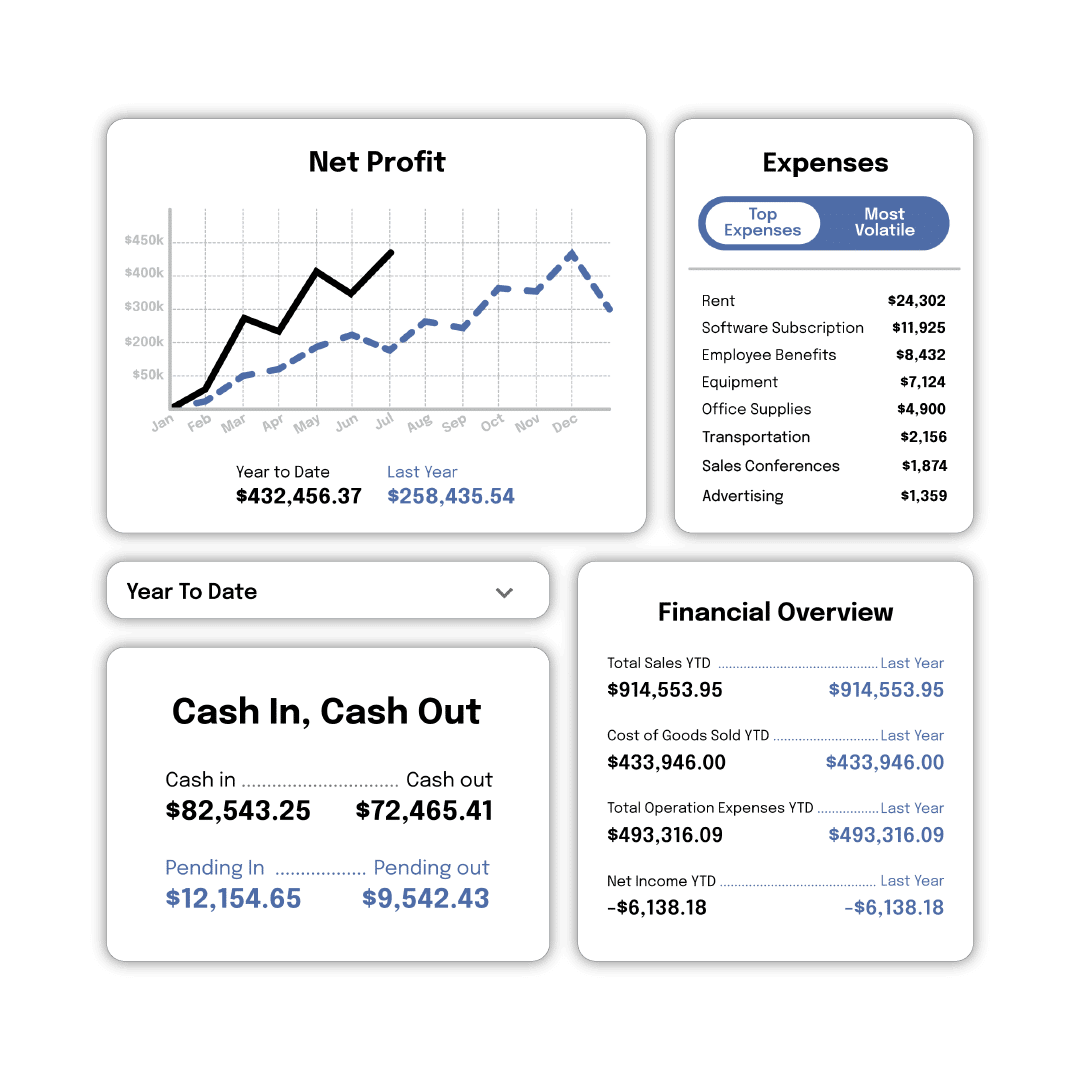

Bookkeeping

Get regular, reliable bookkeeping managed by real human experts.

Tax planning

Don’t just file. Know you’re capitalizing on every available opportunity.

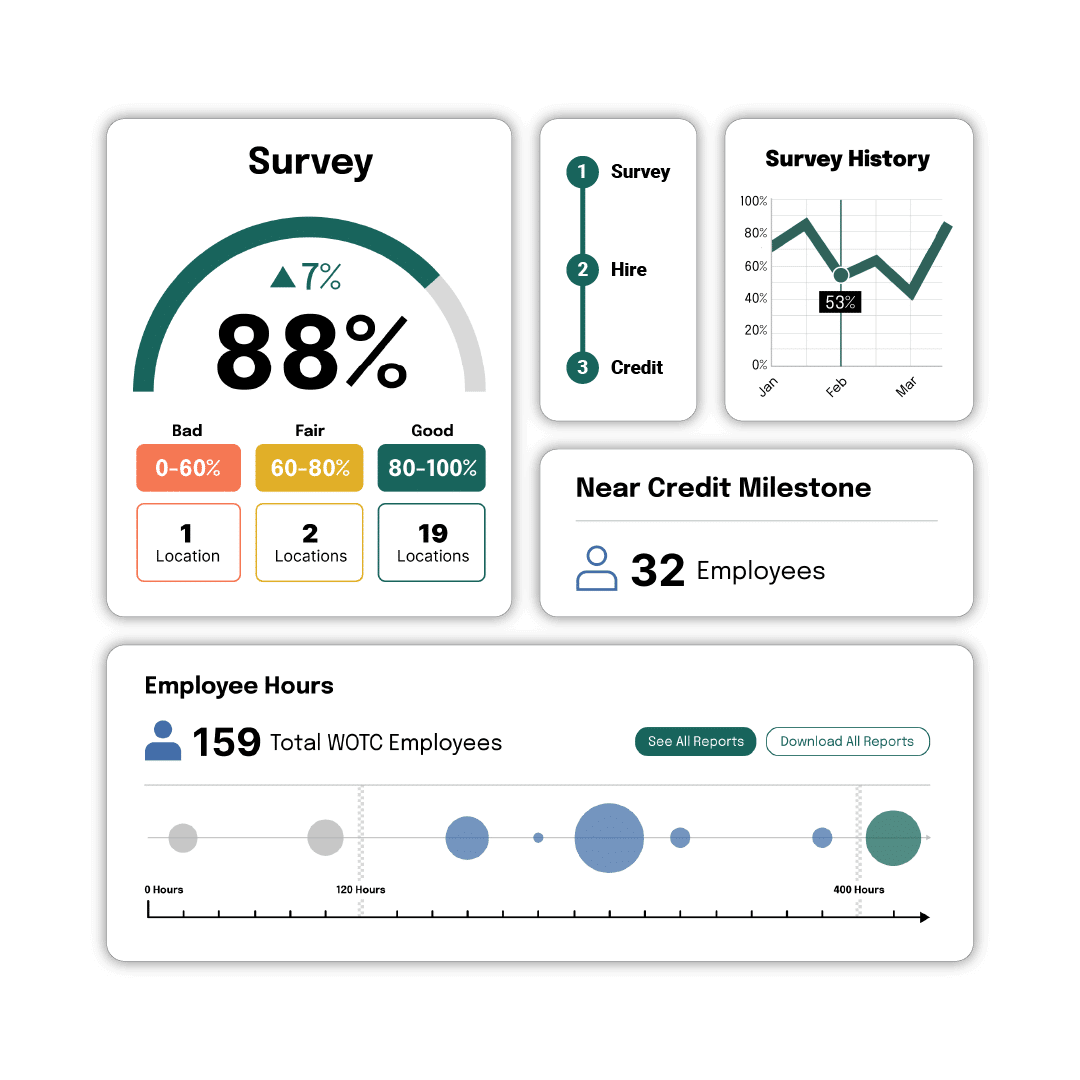

WOTC

Hire disadvantaged job-seekers. Get paid. Win-win.

Small business. Big numbers.

We’re more than just accountants; we’re long-term partners dedicated to your growth. Our commitment is measured in years of collaboration and hard results. The numbers speak for themselves.

2018

Average founding date for our clients

R&D

Most commonly overlooked tax credit for startups and SMBs

$500,000

Total payroll tax offset available to SMBs through the R&D tax credit

“The team at Arvo go above and beyond for our team at Barton Staffing to provide us with weekly reporting along with real-time data to make sure we are capitalizing on each and every opportunity. Arvo Tech is more than a vendor; they are a partner.”

“Take the time to sit down and talk with the Arvo team. It’s worth your time. Within 5 minutes you will say yes.”

“The team was super responsive to our request, timeline, and various questions. We made the decision to pursue the credit pretty late in the game to meet our tax deadline and they really supported us on the effort. All wins in our book.”

“Our experience with the Arvo team was outstanding! We were not familiar with the R&D credit and felt the process would be cumbersome. The Arvo team was really knowledgeable, very responsive, and solutions-oriented.”

“To be honest, I figured claiming the R&D tax credit would be an awful process, kind of like going to the dentist. With Arvo understanding the program was streamlined, easy, and presented in very simple terms. The team did a great job of removing all the clutter; getting down to what mattered most, and walking us through the process.”

“We had done R&D studies with another company that just took way too much employee and management time. And they were very expensive. Then I found Arvo. And it was an entirely different story. Clear directions. Easy software. Helpful people. Reasonable fees.”

Better bookkeeping

Stop letting scattered spreadsheets and outdated reports hold you back. Arvo provides the clear, real-time financials essential for every ambitious startup and growing SMB. Get instant clarity on cash flow, runway, and key metrics, allowing you to confidently pivot, scale, and secure funding without financial guesswork.

Smart tax credits

Don’t leave free capital on the table. Whether you’re innovating with R&D or expanding your team with WOTC-eligible hires, navigating tax credits is complex. Arvo integrates seamlessly with your existing systems, transforming your daily operations into substantial, non-dilutive capital to fuel your next big leap.

Specialists for your industry

Generic servicers miss the nuances that make your business unique. Our experts have deep

experience in key industries, understanding the specific revenue models, compliance

challenges, and tax opportunities that define your field.

experience in key industries, understanding the specific revenue models, compliance

challenges, and tax opportunities that define your field.

Tech

$500,000: Maximum payroll tax credits available annually for startups developing

new products or software.

new products or software.

Manufacturing

61% of all R&D credits are claimed by the manufacturing sector for process

and product improvements.

and product improvements.

Engineering

58% of engineering firms conduct

qualifying R&D, leaving valuable tax

credits unclaimed each year.

qualifying R&D, leaving valuable tax

credits unclaimed each year.

Medical

10-15% of annual revenue can be lost

to medical billing errors; we ensure

you get paid fully.

to medical billing errors; we ensure

you get paid fully.

Construction

$9,600: Maximum tax refund per

new hire with the Work Opportunity

Tax Credit.

new hire with the Work Opportunity

Tax Credit.

Architecture

A landmark 2023 ruling expanded R&D eligibility, rewarding design

and modeling work you’re already doing.

and modeling work you’re already doing.

Research and Development

Turn your investments in innovation and development into a significant cash refund. Many of your company’s everyday activities likely qualify.

Work Opportunity Tax Credit

Get thousands back on your federal taxes for hiring new employees from diverse backgrounds. The process is simple and rewarding.

Aunt Flow saved thousands by filling out one form

Tampon start-up saved taxes for developing socially-conscious product dispenser

Weekly live R&D tax credit webinars

Learn how to take advantage of historic 2025 R&D tax breaks

What’s your growth strategy?

Join over 5,000 businesses that have trusted their tax and accounting with Arvo.

When should my startup hire an accounting service?

The ideal time is from day one. Establishing proper financial systems early prevents costly clean-up down the road and ensures you’re compliant from the start. Clean, accurate books are not just about taxes; they provide the data you need to make critical business decisions and are essential for securing investor funding. Getting it right from the beginning gives you a powerful advantage and lets you focus on your product, not on messy spreadsheets.

How is Arvo different from DIY accounting software?

DIY software is a useful tool for organizing data, but it’s only as good as the information you put in. It can’t provide strategic advice, build a proactive tax plan, or catch nuanced errors. Arvo is a complete solution. We pair powerful technology with a dedicated team of human experts who interpret your data, offer strategic guidance, and ensure you’re not just compliant, but optimized for financial growth and efficiency.

Can a small business or early-stage startup afford Arvo?

Yes. We built Arvo specifically to serve the needs of growing businesses, which is why our prices are designed to scale with you. Think of our service not as a cost, but as an investment in your company’s infrastructure. The money saved through proactive tax planning, optimized financial operations, and the avoidance of costly compliance mistakes means Arvo often pays for itself, delivering a significant return on your investment.

How do you support businesses during fundraising?

We act as a key part of your fundraising team by ensuring your financials are pristine and ready for due diligence at all times. We provide investors with the accurate, timely reports they demand, including Profit & Loss statements, Balance Sheets, and cash flow analysis. Having a professional firm like Arvo managing your books gives investors confidence and allows you to focus on your pitch, knowing your numbers are solid and defensible.