How to claim the WOTC in Florida

Orange you glad the Work Opportunity Tax Credit helps Florida businesses? The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain hours-worked milestones. Employers in […]

WOTC pros gain extra benefits through the Empowerment Zone Credit

The EZ Credit piggy-backs with WOTC, adding an extra layer of profitability for smart businesses Big businesses have long understood the value of the Work Opportunity Tax Credit (WOTC). Now, tech innovations like ours are extending the WOTC to businesses of all sizes, resulting in supercharged profitability, such as 40% boosts in cash flow. Certain […]

How to claim the WOTC in Ohio

We help our fellow Buckeyes get the most from the Work Opportunity Tax Credit The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain hours-worked […]

How much does claiming WOTC cost?

You’ve heard that WOTC can supercharge profitability. Now learn how much it costs. If you’re a business owner or decision maker, you understand that controlling costs is crucial for ensuring profits. And you’re likely well aware of the adage “Time is money.” We understand why your first response after hearing about the transformative potential of […]

How to claim the WOTC in Maryland

Maryland’s state credit match program supercharges WOTC profitability The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain hours-worked milestones. Employers in Maryland received 2.6% […]

WOTC assists nursing homes with hiring and profitability

Learn why the Work Opportunity Tax Credit should be a long-term resident at your facility As America’s population ages, the market for nursing homes is poised for huge growth over the next decade. Of course, this growth will bring with it many new jobs. While that may be good news for job-seekers and business owners, […]

Are my WOTC profits good? This self-audit will tell you

Learn how your Work Opportunity Tax Credit performance measures up Whether you’ve been around the block a few times with the Work Opportunity Tax Credit (WOTC), or you are just beginning to implement it, it’s always worthwhile to assess your program’s performance. After all, optimizing your program can result in profits multiplied more than 600%! […]

WOTC helps home healthcare service providers thrive

The Work Opportunity Tax Credit can rehabilitate your bottom line Few industries will grow as rapidly as home healthcare services in the near future. In fact, the US Bureau of Labor Statistics projected nearly 750,000 jobs will be added to this sector from 2021-2031! If you’re an employer in home healthcare services, this is likely […]

Three common misconceptions about the Work Opportunity Tax Credit

We’ve helped hundreds of organizations profit with WOTC. Here are the three most common misconceptions they have before beginning. For nearly 30 years, the Work Opportunity Tax Credit (WOTC) has rewarded organizations who hire and retain disadvantaged job-seekers with lucrative financial benefits. It’s no exaggeration to say that WOTC can transform businesses when used smartly–particularly […]

WOTC offers big-ticket benefits for retailers

Learn why top retailers keep the Work Opportunity Tax Credit in stock Retail is a trade as old as time. People have always needed goods, and retailers have always provided them. Simple, right? Well…not so much. Just ask a retailer how their business has changed in the last five years. From online shopping to social […]

Companies with the best WOTC profits do these four things

Learn how elite WOTC claimants maximize their profitability The Work Opportunity Tax Credit (WOTC) offers huge tax benefits to employers who hire and retain disadvantaged job-seekers. To get a sense of the scale of these benefits, consider that in April 2024, the US Bureau of Labor Statistics reported 5.6 million new hires. In our experience, […]

WOTC multiplies profits for franchise owners

The Work Opportunity Tax Credit offsets hiring costs, and then some If your business is a franchise–whether it’s a restaurant, gas station, car wash, or something else–it’s likely that hiring quality employees is essential to your success. That’s why, since the pandemic, you’ve probably been managing two hurdles that don’t seem to be going away […]

One in five Americans qualifies for WOTC. Here’s how to find them.

Look to these places first to build your WOTC workforce One of the most common questions we hear after explaining the big tax benefits available through the Work Opportunity Tax Credit (WOTC) is “Where can I find employees who qualify for WOTC?” This question is particularly relevant for staffing firms, or other companies who hire […]

The WOTC is ready to serve restaurants

Tax savings are never 86-ed thanks to the Work Opportunity Tax Credit Few industries have faced bigger challenges than restaurants in recent years. Despite this, the food service industry is projected to top $1 trillion in sales this year, and employ nearly 16 million people. This is all despite the fact that since the pandemic, […]

Five takeaways from Arvo + Aqore’s WOTC webinar

We took notes at “The Power of WOTC,” so you don’t have to Arvo’s Director of Sales and Marketing Emily Osborne presented a free webinar alongside Aqore Staffing Software’s Chief Revenue Officer Steve Zipparro on May 30, 2024. An in-depth exploration of the Work Opportunity Tax Credit (WOTC) program, her presentation answered questions including: What […]

Top staffing firms don’t skip WOTC

The Work Opportunity Tax Credit covers the costs of recruiting and hiring, and then some If recruiting and hiring were simple, the staffing industry wouldn’t exist. What’s more is that since the pandemic, staffing firms have had to clear two hurdles that don’t seem to be going away any time soon: The current and future […]

Is WOTC worth it?

TLDR: Yes…when you work with Arvo If you’ve heard of the Work Opportunity Tax Credit (WOTC), you may already know that: >21% of Americans are eligible for WOTC Maximum credits per employee range from $1,200 to $9,600 Surplus WOTC credits can be carried forward or backward across tax years However, you may be asking yourself […]

WOTC is custom-built for construction companies

WOTC pays you back for filling open roles Through rain, sun, snow, economic slowdowns, and supply chain shortages–if you’re in construction, you do what it takes to keep building. Recently, you’ve likely faced two big problems that may be getting worse: The current and future shortage of skilled workers. Recruitment and hiring costs. Enter the […]

Six ways Arvo’s State Workforce Agency Team saves time and money

To get the most from WOTC, you need the best teammates Many organizations save money on taxes by claiming the Work Opportunity Tax Credit (WOTC). However, few utilize WOTC to its full potential. That’s because claiming the WOTC can be a complicated process. One challenge is gaining certification for WOTC-eligible employees via state workforce agencies […]

Build a strong manufacturing workforce with WOTC

WOTC pays you back for filling open roles Whether your manufacturing company builds with metals, plastics, glass, biologics, or something else, one thing remains true–you need human workers to get the job done. Unfortunately, two problems may be working against you. The current and future shortage of skilled workers. Recruitment and hiring costs. Enter the […]

How much should I get from WOTC?

Optimized WOTC programs can earn >500% more than “good” programs If your business or non-profit participates or is planning to participate in the Work Opportunity Tax Credit (WOTC) program, you may have heard promises of big tax breaks and, as a result, increased cash flow. Many resources exist (such as our WOTC calculator) to help […]

How to claim the WOTC in Minnesota

Over twice as many WOTC certifications as lakes in Minnesota annually The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain hours-worked milestones. Employers in […]

Important WOTC change coming soon

ETA Form 9198 will replace IRS Form 2848 on May 31, 2024 Last June, the Department of Labor announced an important change that anyone who employs a third party (such as Arvo Tech) to manage their Work Opportunity Tax Credit (WOTC) program needs to comply with by May 31, 2024. Formerly, third parties were authorized […]

How to claim the WOTC in Illinois

Illinois businesses gain WOTC certification at high rates The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain hours-worked milestones. Employers in Illinois received 5.32% […]

How does WOTC certification work?

WOTC-eligible employees must be certified by SWAs The Work Opportunity Tax Credit (WOTC) program promises big financial benefits to employers who hire disadvantaged job-seekers. In order to claim the benefits, however, employers must obtain WOTC certification from the appropriate state workforce agency for each WOTC-eligible employee. We’ve helped hundreds of businesses claim over $650 million […]

How to claim the WOTC in Texas

Don’t mess with taxes The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers with tax credits. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain hours-worked milestones. Employers in Texas received 7.5% of […]

How can I make more money with WOTC?

Learn how to get the most from WOTC The Work Opportunity Tax Credit (WOTC) program is a federal employment tax credit program that rewards employers who hire and retain disadvantaged job-seekers with credits against their annual tax liability. The credits are calculated as a percentage of wages paid to WOTC-certified new hires. The percentage raises […]

How to claim the WOTC in California

Employers in California obtained the largest number of WOTC certifications in 2022 The Work Opportunity Tax Credit (WOTC) program rewards employers who hire and retain disadvantaged job-seekers with tax credits. The amount of credit an employer can claim is calculated as a percentage of wages paid to WOTC-eligible new hires, after the employee reaches certain […]

Arvo Tech Acquires Accounting Firms to Deliver Complete Solution for Helping Small Businesses Manage Finances

Leader in Tax Credit Management Technology Integrates Tax Planning and Prep to Help SMBs Optimize their Finances Columbus, OH – March 12, 2024 – Today, Arvo Tech, creator of the tax strategy solution for small businesses, is announcing the acquisitions of Mark Murphy and Associates and Lee and Associates, full-service accounting firms dedicated to […]

When will I receive my ERTC refund?

IRS processing of Employee Retention Tax Credit claims remains stalled The Employee Retention Tax Credit (ERTC), AKA the Employee Retention Credit (ERC), is a refundable tax credit created via bipartisan congressional action in 2020 and 2021 in order to support businesses harmed by government-ordered shutdowns and restrictions during the COVID pandemic. ERTC payments have helped […]

What is a WOTC survey?

Screening applicants is the first step toward claiming the WOTC The Work Opportunity Tax Credit (WOTC) program offers valuable tax benefits to employers who hire disadvantaged job seekers. Businesses with highly effective WOTC strategies can boost their total cash flows by up to 40%. Unfortunately, profits like this are not guaranteed. They are the result […]

How much money can I make with WOTC?

The answer to this simple question relies on a number of factors The Work Opportunity Tax Credit (WOTC) program has rewarded businesses who hire and retain disadvantaged job seekers with valuable tax credits since 1996. Many people have heard of WOTC, but participating in it effectively includes a learning curve. In this blog, we will […]

What is Form 5884?

An introduction for business owners claiming the WOTC If you’re a business owner hoping to benefit from the Work Opportunity Tax Credit (WOTC) program, chances are you’ve encountered IRS Form 5884. In this blog, we’ll answer some common questions about Form 5884. WOTC is designed to help disadvantaged job seekers find and keep work, and […]

Retail stores shouldn’t discount the Work Opportunity Tax Credit

WOTC lowers hiring costs and boosts long-term profits for retailers The Work Opportunity Tax Credit (WOTC) program is designed to benefit both employers and employees. By understanding and leveraging the WOTC, retail stores can significantly boost their bottom line while simultaneously making a positive impact on their communities. Financial benefits WOTC offers substantial financial incentives […]

Seven reasons to ditch your WOTC provider

Horror stories we hear from people who make the switch The Work Opportunity Tax Credit (WOTC) program can boost your bottom line by up to 40%, but only if your WOTC provider performs to the best of their ability. In this blog, we’ll describe the top seven reasons businesses break up with their old WOTC […]

Five reasons why both Democrats and Republicans support the Work Opportunity Tax Credit

WOTC is popular across the aisle thanks to its many attractive benefits The Work Opportunity Tax Credit (WOTC) is a federal tax credit program designed to encourage businesses to hire individuals facing significant barriers to employment. These include veterans, ex-felons, recipients of certain government assistance programs, and more. Although finding common ground can be a […]

Why the WOTC is like a time-traveling tax piggy bank

The Work Opportunity Tax Credit can be carried forward and backward Many organizations already claim the WOTC, but some may not realize that it not only relieves tax burdens now, but also in the past and/or future. For context, there are two kinds of tax credits–”use it or lose it” credits, and those that can […]

When should I file Form 5884?

They say timing is everything. When it comes to Form 5884, they’re right. The Work Opportunity Tax Credit (WOTC) incentivizes employers to hire individuals from specific target groups. Organizations who claim WOTC smartly can see their bottom lines grow by 40% or more. One strategy top WOTC earners use to maximize their credit is filing […]

Arvo Tech and WurkNow Join Forces to Boost Employment Tax Credits

Reimagined tax tech products reignite promising partnership Columbus, OH, February 15, 2024–Arvo Tech, an upstart employment tax credit vendor, has updated its innovative Work Opportunity Tax Credit (WOTC) products, catalyzing expanded adoption among WurkNow clients. Arvo Tech and WurkNow are poised to deliver millions in tax savings to clients including staffing firms through their seamless […]

CPA Academy Webinar

July 25th at 3pm EDT Via the CPA Academy Website

TempNet Fall Conference

September 25-27 Nashville, TN

Staffing World

October 22-24 Nashville, TN

Four employee bonuses that supercharge WOTC profits

If you want to get more from the Work Opportunity Tax Credit, these incentives work The Work Opportunity Tax Credit (WOTC) rewards employers who hire certain disadvantaged job-seekers with valuable tax credits. To be eligible for WOTC, employees must certifiably belong to one of ten federally-designated target groups, including certain veterans, certain individuals with disabilities, […]

Five ways WOTC is a game-changer for staffing firms

The Work Opportunity Tax Credit delivers big value for high-volume employers Staffing firms are problem solvers. They constantly seek innovative ways to deliver top-quality candidates to their clients. That’s why top staffing firms increasingly embrace the Work Opportunity Tax Credit (WOTC)–because WOTC helps them stay ahead of the curve in multiple ways. Here are five […]

Boosting Profits in the Trucking Industry: Unraveling the Benefits of WOTC

In the competitive world of the trucking industry, companies are always seeking ways to enhance their profitability and maintain a competitive edge. One often-overlooked avenue that can significantly impact a trucking firm’s bottom line is the Work Opportunity Tax Credit (WOTC) program. Designed to incentivize the hiring of employees from specific target groups, the WOTC […]

Leveraging WOTC as a Competitive Advantage: Maximizing Profitability for Staffing Firms

In the highly competitive world of staffing firms, finding ways to reduce front-end costs and enhance profitability is essential for success. One often overlooked but highly valuable tool for achieving this is the Work Opportunity Tax Credit (WOTC). By strategically utilizing WOTC, staffing firms can not only save costs but also create a significant […]

The Power of Training on Improving Retention & Maximizing WOTC

Training employees can have a significant impact on both employee retention and the potential for securing more Work Opportunity Tax Credit (WOTC) credits. Here’s how training can positively influence these aspects: Improved Employee Skills and Job Satisfaction: a. Skill Development: Providing training opportunities allows employees to develop and enhance their skills, making them more competent […]

The Powerful Connection Between Employee Wellbeing, Retention, Organizational Success, and WOTC

In today’s fast-paced and competitive business world, organizations are recognizing that their most valuable asset is their employees. Happy and engaged employees not only contribute to a positive work culture but also play a crucial role in driving the success of the organization. We will delve into the profound connection between employee wellbeing, retention, organizational […]

Optimizing Your Business with AI-Enhanced Analytics: A Guide to Maximizing WOTC Tax Credits

In today’s competitive market, small businesses are constantly seeking ways to innovate and stay ahead. Artificial Intelligence, or more precisely, its applications in data analytics and machine learning, has become a beacon of efficiency and strategic planning. These technological advancements, particularly when aligned with the Work Opportunity Tax Credit (WOTC) program, offer a pathway to […]

Maximizing Profitability in Home Health Care with the Work Opportunity Tax Credit (WOTC)

In the fast-paced and demanding home health care industry, optimizing profitability while maintaining high-quality care is crucial for agencies. The Work Opportunity Tax Credit (WOTC) offers a powerful solution that can significantly impact the bottom line of home health care agencies. We’ll explore the specific ways in which the WOTC can help home health care […]

Leveraging the Work Opportunity Tax Credit (WOTC) to Boost Your Restaurant’s Bottom Line

As restaurants navigate the ever-changing landscape of the hospitality industry, finding innovative ways to cut costs and enhance profitability is crucial. One often overlooked opportunity for restaurants is the Work Opportunity Tax Credit (WOTC) program, which offers substantial benefits for hiring from specific target groups. We’ll explore how restaurants can leverage WOTC to their advantage […]

Creating More Sales for Staffing Firms by Using WOTC as a Sales Tool

As a staffing firm, the Work Opportunity Tax Credit (WOTC) can provide significant benefits to your sales team by offering additional value propositions and incentives to potential clients. WOTC can enhance your sales efforts in the following ways: Cost Savings for Clients: WOTC offers potential clients the opportunity to reduce their federal income tax liability by […]

Top 10 WOTC Questions Asked

We often have companies that ask questions with regards to their eligibility for WOTC and how to run the program. Please see the questions and answers below: #1 How do I know if my company qualifies for WOTC? Both For-Profit and Non-Profit companies can qualify for WOTC. The key is that you hire employees […]

A Personal WOTC Specialist Versus a Call Center Approach

When it comes to handling Work Opportunity Tax Credit (WOTC) applications, there are two main approaches: using a personal WOTC specialist or working with a call center. Both options have their advantages and drawbacks, and the choice depends on your specific needs and preferences. Personal WOTC Specialist Dedicated Attention: Working with a personal WOTC specialist […]

Ensure Your WOTC Vendor is Only Using Your Information for WOTC

Now more than ever, it is crucial to ensure your Work Opportunity Tax Credit (WOTC) vendors use both your personal information and your candidate information only for the purpose of processing WOTC. There are many vendors that have other services that they offer such as credit bureaus, payroll services, etc. You must take specific […]

Converting WOTC Candidates into Valuable Employees

Hiring WOTC (Work Opportunity Tax Credit) candidates can bring numerous benefits to your organization, but it’s essential to have a plan in place to successfully convert them into valuable employees. Today, we will explore five key strategies to help you transition WOTC candidates into engaged and productive members of your team, contributing to your […]

Avoiding the # 1 Mistake to Prevent for WOTC Success

When it comes to taking advantage of government programs that benefit businesses, Work Opportunity Tax Credit (WOTC) stands out as a valuable opportunity. However, many companies inadvertently miss out on the potential benefits due to a common mistake: inadequate employee screening. Today we will explore this key mistake and provide insights on how to […]

How WOTC Can Make a Positive Impact on Your Sales

WOTC (Work Opportunity Tax Credit) can potentially help businesses in various ways, including positively impacting sales. Here are a few ways in which WOTC can potentially contribute to sales growth: Hiring Incentives: WOTC provides tax incentives to businesses that hire individuals from specific target groups, such as veterans, long-term unemployed individuals, ex-felons, and others. By […]

Top Factor that will prevent Work Opportunity Tax Credit Success

Implementing a Work Opportunity Tax Credit (WOTC) program can bring substantial financial benefits to businesses. However, the success of such a program hinges on 1 key factor…effective communication and employee awareness. Without clear and comprehensive communication, employees may remain uninformed about the program’s purpose, eligibility criteria, and potential tax credits. Today we will explore […]

Arvo Tech Study Finds 6 in 10 SMBs Took Advantage of Tax Incentive Programs in 2022, Up 14 Percent YoY

This year has been a turbulent time for business owners, with inflation, rising interest rates and a volatile economy. To combat losses and help support growth, more small and mid-sized businesses (SMBs) participated in federal and state incentive programs this year, according to a new study from Arvo Tech, the leading technology platform that helps […]

Unlocking Success: 5 Key Strategies for Small Businesses

Running a small business can be both challenging and rewarding. To achieve long-term success, small businesses must navigate a competitive landscape while maximizing their strengths. Today we’ll explore five key strategies that can help small businesses thrive and overcome common hurdles on the path to success. #1 Clear Vision and Goals: Having a clear […]

The Power of Happiness: Fueling Employee Engagement and Retention for WOTC Success

The key to maximizing WOTC has a direct correlation to employee retention. In today’s competitive business landscape, attracting and retaining talented employees is essential for organizational and WOTC success. While various factors contribute to employee engagement and retention, one powerful catalyst often overlooked is happiness. When employees feel genuinely happy in their work environment, […]

Gamifying Your WOTC Program: Boosting Engagement and Maximizing Results

Implementing the Work Opportunity Tax Credit (WOTC) program can bring significant benefits to your organization, both financially and in terms of talent acquisition. To further enhance employee engagement and participation in the WOTC program, incorporating gamification elements can be a game-changer. Today we’ll explore how gamification can make your WOTC program more engaging, motivating, […]

Five Ways the Work Opportunity Tax Credit (WOTC) Can Improve Your Business

Every business aims to maximize its financial performance and create a thriving workplace environment. One way to achieve these goals is by taking advantage of the Work Opportunity Tax Credit (WOTC) program. WOTC offers valuable benefits to businesses that actively hire individuals from specific target groups facing employment barriers. Let’s explore how implementing WOTC can […]

How WOTC Can Help ATS’s Gain More Clients

As an ATS (Applicant Tracking System) vendor, integrating WOTC (Work Opportunity Tax Credit) functionality into your platform can offer several benefits that can help you attract and gain more clients. Here are several ways WOTC can help: Cost Savings for Clients: By integrating WOTC into your ATS, you can help your clients save money. WOTC […]

3 Strategies to Help Candidates Complete the WOTC Survey

Getting candidates to complete the WOTC (Work Opportunity Tax Credit) form can be crucial in maximizing the potential benefits for employers. Here are three key strategies to encourage candidates to complete the WOTC form: Clear Communication and Education: Explain the Purpose and Benefits: Clearly communicate to candidates the purpose and benefits of completing the WOTC […]

Certified WOTC Credit vs. Potential Credit: Understanding the Difference

The Work Opportunity Tax Credit (WOTC) program provides valuable tax incentives to employers who hire individuals from specific target groups. When participating in WOTC, it is essential to understand the difference between a certified WOTC credit and a potential credit waiting on the state workforce agency’s determination. Today we will explore the distinction between […]

Electronic vs. Paper: The Difference in Screening for WOTC

Screening for Work Opportunity Tax Credits (WOTC) is a critical step in identifying eligible candidates and maximizing your tax savings. When it comes to WOTC screening, you have the option to choose between electronic screening or traditional paper forms. Today we will explore the key differences between electronic and paper screening methods and highlight the […]

The Crucial Importance of Screening for WOTC Before Employee Hire Date

The Work Opportunity Tax Credit (WOTC) program offers valuable tax incentives to employers who hire individuals from specific target groups. To take full advantage of this program and maximize your tax savings, it is crucial to implement a comprehensive screening process for WOTC eligibility on or before the employees’ hire date. Let’s explore why […]

Converting Candidates into Valuable Employees: Three Winning Strategies

Hiring the right candidates is only the first step in building a successful team. To truly capitalize on their potential, it’s crucial to convert candidates into engaged and committed employees. We will explore three effective strategies that can help you seamlessly transition candidates from the hiring process to becoming valuable contributors within your organization. […]

Maneuvering the Hiring Challenges in the Post-“Great Resignation” Era

The recent phenomenon dubbed the “Great Resignation” has sent shockwaves through the employment landscape. As workers reassess their priorities and seek new opportunities, employers face unique hiring challenges. We will explore the aftermath of the Great Resignation and provide insights on how businesses can navigate the hiring landscape in this evolving environment. Increased Competition […]

Drive WOTC Results through Friendly Competition: Ignite Your Team’s Potential!

Are you looking for a powerful strategy to boost the results of your Work Opportunity Tax Credit (WOTC) program? Look no further! In this competitive world, harnessing the power of friendly competition can provide the spark your team needs to excel in capturing WOTC benefits. By infusing a spirit of rivalry, collaboration, and motivation, you […]

Navigating the Hiring Landscape During a Recession or Down Economy

In times of economic recession or downturn, the hiring landscape undergoes significant shifts. Businesses face unique challenges, and hiring decisions become more critical than ever. We will explore the interplay between a recession or down economy and hiring, uncover the key considerations for employers, and provide strategies to navigate this challenging terrain effectively. Decreased Hiring […]

Job Seekers: Discover the Work Opportunity Tax Credit (WOTC) Program to Increase Your Job Chances

Attention, job seekers! Are you aware that certain employers are offered enticing tax incentives for hiring individuals like you? In today’s competitive job market, it’s essential to explore all avenues to stand out and find the right opportunities. One such avenue is the Work Opportunity Tax Credit (WOTC) program, which not only connects job seekers […]

Does Your WOTC Program Need a Tune Up?

The Work Opportunity Tax Credit (WOTC) program has long been a valuable tool for businesses to incentivize the hiring of individuals from specific target populations. By providing tax credits to employers who hire and retain eligible individuals, the WOTC program promotes workforce diversity, inclusion, and economic growth. However, like any program, it may require periodic […]

Get Optimum WOTC Results with Arvo’s 3 x 5 Strategy

As employees are asked to do even more, many times managing your WOTC program can be often forgotten amongst their other responsibilities. At Arvo, our goal is to ensure that you operationalize WOTC where it becomes 2nd nature and part of your standard operating procedures. To do this, we offer a simple, yet very […]

3 TIPS TO IMPROVE YOUR WOTC ELIGIBILITY AT YOUR STAFFING FIRM

At Arvo, our clients understand that one of the keyways to increase your WOTC credits is to increase the number of WOTC eligible employees you hire. To do this, you can’t just depend on eligible candidates walking through your doors. In this blog post we want to give you 3 tips you can immediately […]

Choosing the Right WOTC Vendor for Your Company

When evaluating and selecting WOTC (Work Opportunity Tax Credit) vendors, there are several factors to consider to ensure you make the right choice. Here are some key indicators to help you determine if a WOTC vendor is the right fit for your organization: Experience and expertise: Look for vendors with a solid track record in […]

Does Your WOTC Vendor Have a SOC 2 Compliance Certification to Protect Your Data?

With WOTC one of the necessary items to execute a program is payroll information along with candidate information. With the increased cyber security attacks it imperative that your WOTC vendor have a strong commitment to protecting your data. One effective way to achieve this is by obtaining SOC 2 compliance which is what we at […]

The Importance of Goal Setting or Maximizing WOTC Success

When it comes to taking full advantage of the Work Opportunity Tax Credit (WOTC), goal setting plays a crucial role. By setting clear and specific goals, organizations can ensure they are effectively utilizing the available credits and taking the necessary steps to achieve desired outcomes. In this blog post, we will explore why goal setting […]

Educate Your Team for Maximum WOTC Results

The Work Opportunity Tax Credit (WOTC) program presents a tremendous opportunity for businesses to reduce their tax liability by hiring individuals from specific target groups. However, to achieve the best possible results from WOTC, it is crucial to educate your team about the program and empower them with the knowledge to identify and capture eligible […]

Maximizing Your WOTC Credits: The Role of a WOTC Vendor’s Customer Service

As a business owner or HR professional, you may have heard about the Work Opportunity Tax Credit (WOTC) program, a federal tax credit program that rewards employers for hiring individuals from specific target groups. But how can you ensure you’re taking full advantage of this program and maximizing your WOTC credits? That’s where the customer […]

Arvo Tech Announced as Employment Tax Credit Provider for Gusto, Leader in Payroll, Benefits, and HR

Leader in Employment Tax Credit Technology Integrates to Help Raise Awareness Around Employment-Based Tax Credits COLUMBUS, Ohio, Aug. 23, 2023 /PRNewswire-PRWeb/ — Today, Arvo Tech, the platform that helps employers transform cashflow by simplifying access to employment tax credit opportunities, is announcing that they are the exclusive employment tax credit provider for Gusto, an integrated […]

Arvo Tech Integrates with Leading ATS and Recruitment Software Provider Bullhorn

At Arvo, we are very excited about our newest integration which is with Bullhorn as their first blueprint WOTC and Tax Credits automation integration. In selecting Bullhorn as an integration partner, we took in several key factors when making the decision: Expertise & Experience Compatibility & Scalability Robust Integration Capabilities Reliability & Security Strong Communication […]

Why Arvo Tech Makes a Great Integration Partner

When selecting an integration partner for your business, several key factors should be considered. These factors will help ensure a successful and seamless integration process. Here are some essential elements to look for in an integration partner: Expertise and Experience: Choose an integration partner that has a proven track record of expertise and experience in […]

Unlock Tax Benefits: A Step-by-Step Guide to Claiming the Work Opportunity Tax Credit

As a business owner, you have the power to make a positive impact by hiring individuals from targeted groups and contributing to a more inclusive workforce. The Work Opportunity Tax Credit (WOTC) program not only promotes diversity but also offers significant tax benefits for employers. In this blog, we’ll walk you through the process of […]

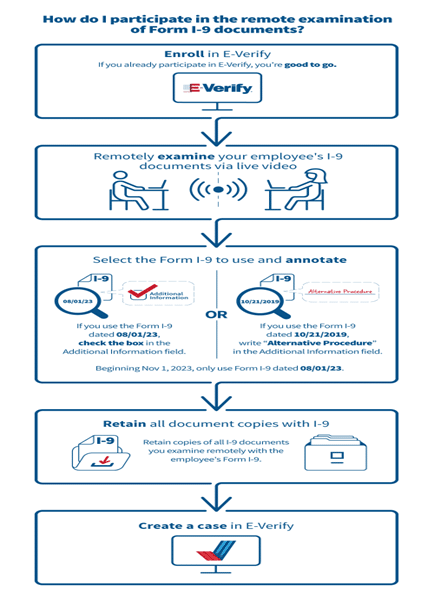

New Form I 9; Notice Published Allowing E Verify Employers to Remotely Examine Form I 9 Documents

As a client of Arvo, we want to keep you in the know. As you may or may not know the USCIS created a new version of Form I-9 which also allows I for you to participate in the remote examination of Form I-9 documents. See below from the U.S. Citizenship and Immigration Services website: […]

How WOTC Benefits the Vocational Rehabilitation Category

Opening Doors to Success: How WOTC Benefits Vocational Rehabilitation In our quest for a more inclusive society, it’s crucial to create equal opportunities for individuals in vocational rehabilitation. These individuals, who may face challenges due to disabilities or other circumstances, possess unique talents and capabilities that can greatly contribute to the workforce. Enter the Work […]

Unlocking Opportunities: How the WOTC Benefits the SSI Target Group

In today’s world, equal employment opportunities are crucial to creating a more inclusive society. For individuals who are part of the Supplemental Security Income (SSI) target group, finding employment can be challenging due to disabilities or other circumstances. However, the Work Opportunity Tax Credit (WOTC) program provides a lifeline, offering significant benefits to both employers […]

Unlocking Second Chances: The Significance of the Work Opportunity Tax Credit for Ex-Felons

Reintegrating into society after incarceration can be a difficult journey for individuals with criminal records. To support their successful reentry and reduce recidivism rates, programs like the Work Opportunity Tax Credit (WOTC) offer a way and hope. Let’s explore the significance of WOTC for ex-felons, highlighting how it can create employment opportunities and foster their […]

3 Strategies for Recruiting Work Opportunity Tax Credit-Eligible Candidates

As employers, we have the opportunity to make a positive impact not only within our organizations but also in the lives of individuals from diverse backgrounds. The Work Opportunity Tax Credit (WOTC) provides a valuable incentive for hiring individuals from target groups such as veterans, individuals receiving public assistance, and ex-felons. Here are three effective […]

Maximizing the Work Opportunity Tax Credit: The Importance of Applicant Tracking System Integration

As employers strive to maximize their recruitment efforts and tap into available tax incentives, integrating with an Applicant Tracking System (ATS) becomes crucial. This is especially true when it comes to harnessing the benefits of the Work Opportunity Tax Credit (WOTC). In this article, we will explore the significance of integrating WOTC with your ATS […]

Why WOTC Employees are More Profitable and Excel in the Workplace for Employers

Hiring and retaining productive employees is crucial for any business’s success. The Work Opportunity Tax Credit (WOTC) program offers more than just tax incentives to employers. We will explore why WOTC employees have been shown to be more profitable than non-WOTC employees, and how leveraging this program can benefit businesses in multiple ways. Enhanced Skill […]

Why Targeting WOTC-Eligible Employees Should be Your Strategy in a Tight Labor Market

In a tight labor market where finding qualified candidates is a challenge, employers must adopt innovative strategies to gain a competitive edge. One such strategy is targeting WOTC-eligible employees—individuals from specific target groups who face barriers to employment. We will explore why focusing on WOTC-eligible employees should be your strategy in a tight labor market […]

Maximizing Benefits: How Payroll Integration Enhances Your Work Opportunity Tax Credit (WOTC) Program

Are you taking full advantage of your Work Opportunity Tax Credit (WOTC) program? If not, it’s time to explore how integrating your payroll system can boost the effectiveness and efficiency of your WOTC program. Here’s how having a payroll integration can benefit your WOTC program: 1. Streamlined Eligibility Verification Integrating your payroll system with WOTC […]

Mental Health Impact of Business Owners and Leadership of an Organization

Mental health has become an epidemic in the business world ever since COVID hit. It doesn’t just impact employees of an organization, but can have a significant impact on its business owners and leaders. When determining whether or not you are being impacted, here are a few key areas to review: Decision-Making and Problem-Solving Mental […]

The Benefits of Small Businesses Participating in the Work Opportunity Tax Credit Program

Small businesses are the backbone of our economy, driving innovation, creating jobs, and fostering local communities. In an effort to support these enterprises and promote equal employment opportunities, the Work Opportunity Tax Credit (WOTC) program offers a range of benefits. By participating in the WOTC program, small businesses can not only save on their tax […]

The Key to Maximizing WOTC: Retention Strategies for Your Workforce

Retaining employees is not only essential for maximizing your work opportunity tax credits, but for your long-term success and stability of your organization. Here are some effective strategies to help retain your employees: Competitive Compensation Ensure that your employees are fairly compensated for their skills, responsibilities, and market value. Regularly review and adjust their salaries […]

Mental Health and Its Impact on Employee Retention

The working world is facing an epidemic that centers around mental health. Mental health can play a significant role in employee retention, work productivity, and the overall culture of your company. Most organizations overlook this factor when determining why employees turnover as well as the health of their organization. To investigate the impact of mental […]

Maximizing WOTC: 120 Hours vs 400 Hours

The Work Opportunity Tax Credit, or WOTC, is a federal tax credit available to businesses hiring individuals from targeted groups who consistently face barriers to employment. There are many reasons to participate in WOTC – it benefits workers by increasing access to good jobs, it benefits companies by increasing workplace diversity, and it benefits employers […]

From Unemployment to Success: How the Work Opportunity Tax Credit Benefits Everyone

The Work Opportunity Tax Credit (WOTC) is a federal tax credit that encourages employers to hire individuals from targeted groups who may face barriers to employment. The program provides a tax credit to employers who hire individuals from targeted groups, such as veterans, ex-felons, long-term unemployed individuals, and individuals with disabilities. In this article, we […]

Importance of Your WOTC Vendor Having a State Workforce Agency Liaison Team

As a business owner, you are always looking for ways to maximize your profits while minimizing expenses. One of the most effective ways to do this is to take advantage of tax credits offered by the government. The Work Opportunity Tax Credit (WOTC) is one such credit that can significantly reduce your tax liability, increasing […]

The Smart Employer’s Guide to Unlocking WOTC Tax Savings

Are you looking for a way to reduce your tax bill and save money on your company’s bottom line? If so, you may be interested in the Work Opportunity Tax Credit (WOTC). This tax credit is available to companies that hire employees from specific groups and can provide significant savings on your tax bill. In […]

WOTC Credits Continue to Grow Year-After-Year

The Work Opportunity Tax Credit (WOTC) is a federal tax credit designed to encourage businesses to hire individuals who face significant barriers to employment. These barriers can include being a veteran, ex-felon, receiving certain types of public assistance, or having a disability. WOTC has been in existence since the mid-1990s, and it has been growing […]

Maximizing Social Impact: The Work Opportunity Tax Credit for Non-Profits

Non-profit organizations play a vital role in addressing societal needs and promoting social welfare. To further their missions, non-profits can leverage various resources, including financial incentives like the Work Opportunity Tax Credit (WOTC). In this blog post, we will explore how non-profit organizations can harness the power of the WOTC to maximize their social impact […]

Unlocking Opportunities: The Significance of the Work Opportunity Tax Credit for Veterans

As a nation, we owe a debt of gratitude to the men and women who have served in the armed forces. Beyond expressing our gratitude, it is essential to provide tangible support to our veterans as they transition into civilian life. One valuable tool in this endeavor is the Work Opportunity Tax Credit (WOTC). In […]

Debunking the 5 Myths of the Work Opportunity Tax Credit

The Work Opportunity Tax Credit (WOTC) is a federal tax credit designed to incentivize employers to hire individuals from certain target groups facing barriers to employment. Despite its potential benefits, there are several misconceptions surrounding WOTC. In this blog post, we aim to debunk these myths and shed light on the true nature of the […]

The Empowerment Zone Credit: Unlocking Growth Opportunities for Businesses

In the realm of tax credits, the Empowerment Zone Credit stands out as a powerful incentive that not only benefits businesses but also empowers communities. Designed to stimulate economic development and job creation in designated distressed areas, this credit offers a unique opportunity for businesses to make a positive impact while enjoying significant tax savings. […]

Columbus fintech firm helps small, medium businesses claim tax credits

A Columbus fintech company quadrupled revenue since the creation of a pandemic-related tax credit that it helps employers claim.